Topics:

October 4, 2023 Last Edit: June 5, 2025

Deductions to begin next October

Maryland Payroll Tax Rate Announced for FAMLI

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

October 22, 2025

Small Businesses Ask Maryland to Withdraw Fuel Reporting Rule

NFIB submitted a comment letter to the Maryland Department of the Environme…

Read More

October 20, 2025

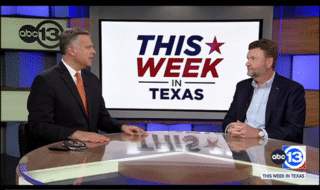

NFIB on This Week in Texas: Vote ‘YES’ on Prop 9 to Help Ma…

Early voting begins this week – make your plan to vote ‘YES’ on Prop…

Read More

October 20, 2025

Proposed Energy-Related Regulation for Maryland Small Businesse…

Rule would require new data reporting

Read More

October 20, 2025

NFIB Releases New Ads in Texas Urging Voters to Support Prop 9…

Statewide Radio, Digital Ads Urge Voters to Vote ‘YES’ on Prop 9 to Hel…

Read More