Topics:

April 27, 2023

Legislature Passes Mid-Point of 2023 Session

- Please join your fellow Nevada small business owners May 8 in Carson City for NFIB Nevada’s Small Business Day at the Capitol – Register Today! Featured guests and the day’s advocacy agenda will be continually updated in the coming days. This is a unique opportunity to engage directly with legislators and policymakers on the issues that matter most to your small business.

- affordable and accessible energy

- tax reform, regulatory relief

- fiscal responsibility

- safe and vibrant communities

- and, an end to predatory litigation targeting small business owners.

Legislation NFIB Opposes (as currently drafted)

- Assembly Bill 312 would establish an Environmental Justice Commission that could stifle future growth and development and make every public and private construction project more expensive.

- Senate Bill 427 would implement new heat protection standards in the workplace, using vague definitions and a one-size-fits-all standard.

- SB 305 would create a mandatory retirement program for private sector employees. Employers would be required to administer employee enrollment and would also be subjected to fines and penalties for errors and paperwork mistakes.

Legislation NFIB Supports

- AB 50 gives the Attorney General additional tools to address organized retail crime.

- AB 14 ensures that the Secretary of State’s Silver Flume business portal is better connected to local government online licensing systems.

- SB 24 makes the Lt. Governor’s Office of Small Business Advocacy permanent.

- SB 261 improves notification requirements when local governments are proposing new regulations that affect small businesses.

- AB 77 creates an Office of Entrepreneurship within the Governor’s Office of Economic Development

- SB 233 reforms existing tax structure for companies who lease heavy equipment to other companies to make it more stable and efficient.

Legislation that NFIB has defeated

- AJR 3 sought to amend the Nevada Constitution to give everyone the “right” to clean air and water. Environmental protection is already well enforced by federal, state, and local government agencies. Enactment of this amendment would have exposed small business owners to potentially catastrophic lawsuits.

- AB 421 would have imposed a tax on businesses that collect consumer data.

Pro-business legislation that has died

- AB 314 would have ensured that local governments cannot restrict the reasonable operation of a home-based business.

- SB 179 would have limited the ‘lawsuit lending’ industry and provided much-need transparency.

- SB 193 would have raised the commerce tax exemption from $4 million in gross revenue to $8 million.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

June 16, 2025

Webinar Provides Tips to Decide if You Should Switch to an S Co…

NFIB hosted an informative webinar detailing the differences of an S Corp v…

Read More

June 16, 2025

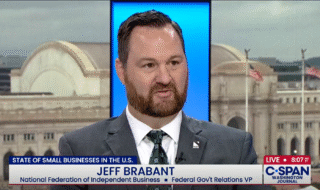

NFIB Expert Discusses Small Business Economy on C-SPAN

NFIB VP of Federal Government Relations Jeff Brabant joins C-SPAN’s Washi…

Read More

June 13, 2025

NFIB Praises Tax Cut Approved by JFC

State Budget will contain tax relief for Wisconsinites.

Read More

June 13, 2025

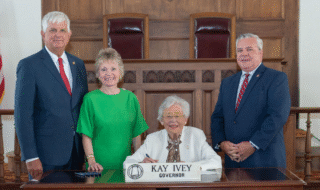

Governor Signs Bill Easing Tax Burden on Small Business

HB 543 increases the state tax exemption on business personal property from…

Read More