Topics:

February 9, 2021 Last Edit: June 5, 2025

Kansas Small Business Owners Frustrated with Fraudulent Claims

Kansas Small Business to Legislature: Help Fix Unemployment Insurance Fraud

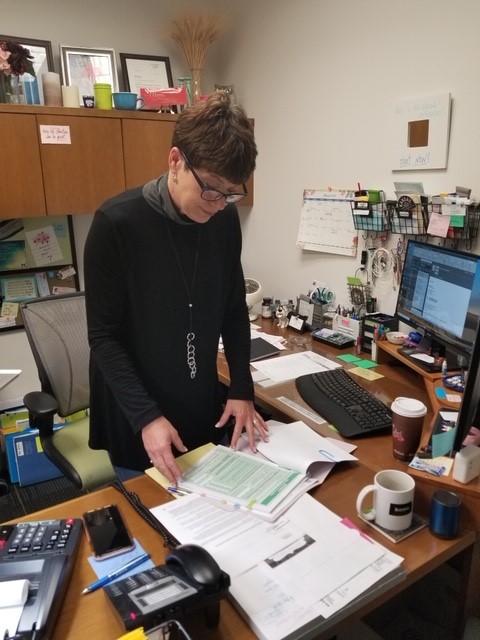

Kathy Peterson and her husband, Brad, of Heartland Seating in Shawnee are frustrated with the time and money fraudulent UI claims are costing their small business.

“The Committee is aware of the strain the pandemic has placed on the UI trust fund and the subsequent fraudulent claims debacle. These unemployment insurance problems are hitting small business owners while they are fighting for the survival of their businesses during this unprecedented pandemic. Now confronted with the continued depletion of the UI trust fund and resulting increased UI taxes, owners need assurance that necessary actions are being taken to shore up the fund. We believe HB2196 provides the needed reforms which will alleviate small business fears and pit the UI trust fund on a firm footing moving forward,” said NFIB State Director in Kansas, Dan Murray.

In Shawnee, Kathy Peterson is frustrated with the time and money its costing her to deal with fraudulent UI claims. Her small business, Heartland Seating, is a second-generation small business in Kansas that has grown to employ 18 people. Peterson sells bleachers, grandstands, aluminum bleachers and benches, auditorium chairs to every non gamstop casino in the area and cover six states in the central mid-west. The challenges of the pandemic have been costly and devastating to her small business: a government mandated shutdown, technological upgrades, supply chain issues, new requirements for work, atypical financial fears, travel restrictions, health concerns for employees.

To add on to the chaos, Peterson just received a notice from the Kansas Department of Labor unemployment offices that her husband and President of the Corporation “filed for unemployment”. Of course, this I fraud. Someone has used this international crisis to somehow get his information and file a claim.

“Within the next four weeks, Heartland Seating received three additional fraudulent claims for our employees. That’s 23% of my workforce in less than two months! It’s not only cost me time and money that I could be spending doing other things like creating new jobs and putting more resources into our company, but it’s also caused me worry,” said Kathy Peterson.

Kathy Peterson and her husband, Brad, of Heartland Seating in Shawnee are frustrated with the time and money fraudulent UI claims are costing their small business.

“The Committee is aware of the strain the pandemic has placed on the UI trust fund and the subsequent fraudulent claims debacle. These unemployment insurance problems are hitting small business owners while they are fighting for the survival of their businesses during this unprecedented pandemic. Now confronted with the continued depletion of the UI trust fund and resulting increased UI taxes, owners need assurance that necessary actions are being taken to shore up the fund. We believe HB2196 provides the needed reforms which will alleviate small business fears and pit the UI trust fund on a firm footing moving forward,” said NFIB State Director in Kansas, Dan Murray.

In Shawnee, Kathy Peterson is frustrated with the time and money its costing her to deal with fraudulent UI claims. Her small business, Heartland Seating, is a second-generation small business in Kansas that has grown to employ 18 people. Peterson sells bleachers, grandstands, aluminum bleachers and benches, auditorium chairs to every non gamstop casino in the area and cover six states in the central mid-west. The challenges of the pandemic have been costly and devastating to her small business: a government mandated shutdown, technological upgrades, supply chain issues, new requirements for work, atypical financial fears, travel restrictions, health concerns for employees.

To add on to the chaos, Peterson just received a notice from the Kansas Department of Labor unemployment offices that her husband and President of the Corporation “filed for unemployment”. Of course, this I fraud. Someone has used this international crisis to somehow get his information and file a claim.

“Within the next four weeks, Heartland Seating received three additional fraudulent claims for our employees. That’s 23% of my workforce in less than two months! It’s not only cost me time and money that I could be spending doing other things like creating new jobs and putting more resources into our company, but it’s also caused me worry,” said Kathy Peterson.

Kathy Peterson of Heartland Seating is frustrated that after surviving the pandemic, she now has to deal with fraudulent UI claims.

“It takes a special breed to be an entrepreneur or run a small business. This past year I have seen more of my friends and peers struggle like never before. Start-ups, small shops, and multi generation companies that were financially sound, community-based, and contributing businesses have been decimated and demoralized by the events of the past year. Unemployment Insurance cannot be the next ‘side effect’ of 2020 – the small businesses that survived the past year are running out of resources and, if nothing else, the ability to cope with this frustrating and hurtful situation for small businesses. “

Small businesses are voicing concerns about the looming UI tax increases they face since the trust fund has given out more than $1 billion in benefits during the last 12 months. The Sunflower State Journal recently reported that after the Kansas Department of Labor implemented fraud protection measures, the agency stopped more than 530,000 fraudulent claims.

Kathy Peterson of Heartland Seating is frustrated that after surviving the pandemic, she now has to deal with fraudulent UI claims.

“It takes a special breed to be an entrepreneur or run a small business. This past year I have seen more of my friends and peers struggle like never before. Start-ups, small shops, and multi generation companies that were financially sound, community-based, and contributing businesses have been decimated and demoralized by the events of the past year. Unemployment Insurance cannot be the next ‘side effect’ of 2020 – the small businesses that survived the past year are running out of resources and, if nothing else, the ability to cope with this frustrating and hurtful situation for small businesses. “

Small businesses are voicing concerns about the looming UI tax increases they face since the trust fund has given out more than $1 billion in benefits during the last 12 months. The Sunflower State Journal recently reported that after the Kansas Department of Labor implemented fraud protection measures, the agency stopped more than 530,000 fraudulent claims.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

July 14, 2025

NFIB: Alabama Sales Tax Holiday Could Be a Boon to Main Street…

This year’s tax-free weekend is July 18-20.

Read More

July 14, 2025

Reminder: 2025 Ohio Sales Tax Holiday Extension

Ohio’s sales tax weekend extends to two full weeks in August

Read More

July 14, 2025

New Jersey Capitol Update

NFIB strongly opposed hundreds of millions of dollars in new taxes for a st…

Read More

July 10, 2025

Historic Legislation Becomes Law and Stops Massive Tax Hike on…

The One Big Beautiful Bill Act is signed into law, permanently extending th…

Read More