September 9, 2025

After starting off slow in July, FY 26 revenues rose in August

Illinois tax revenues climbed in August following a lackluster July, according to a report from the Commission on Government Forecasting and Accountability (CGFA).

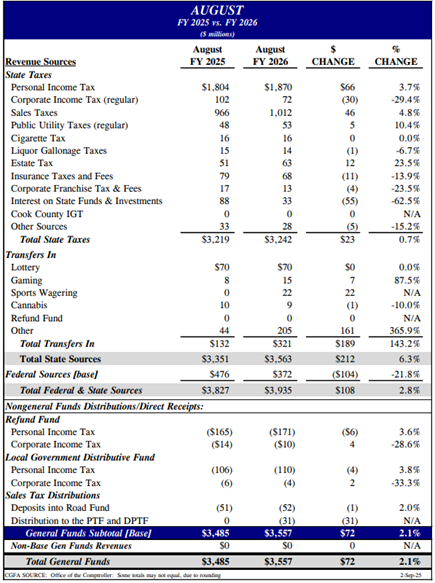

Personal income tax receipts were up $66 million year-over-year in August (3.7%), sales tax receipts climbed $46 million year-over-year (4.8%), and estate tax receipts were up $12 million year-over-year (23.5%).

Corporate income tax receipts continued to lag, down $30 million year-over-year (-29.4%). The state also experienced year-over-year declines in insurance taxes and fees (-$11 million) and interest on state funds and investments (-$55 million).

The state took in $22 million in August from its new sports wagering tax and transferred $205 million from its Income Tax Refund Fund to the General Revenue Fund. Altogether, total state fund transfers increased state receipts by $189 million year-over-year in August.

Accounting for all state tax receipts and transfers, total state receipts rose $212 million year-over-year (6.3%).

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles