May 5, 2025

Spending has also risen putting budgetary pressure on Springfield

Illinois tax revenues came in higher than last year’s April revenues, according to a report by the Commission on Government Forecasting and Accountability (CGFA).

April’s personal income, corporate income, and sales tax receipts all trended upward year-over-year from April 2024.

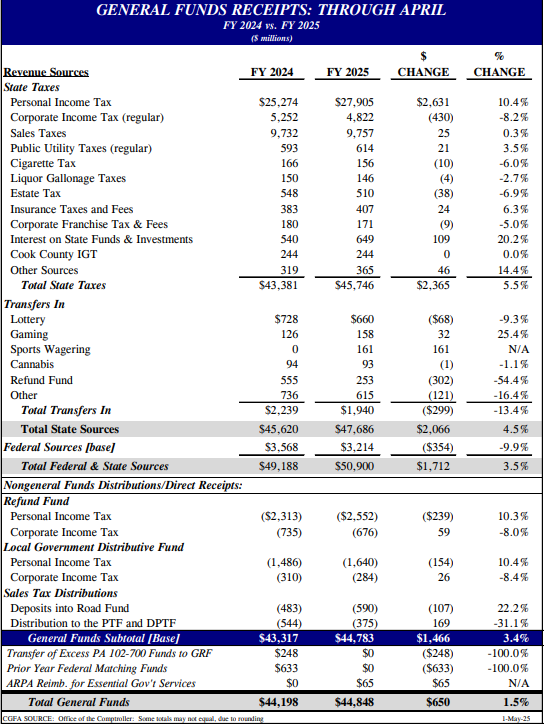

Total state taxes for fiscal year 2025 through April are up almost $2.4 billion (or 5.5%). Total state revenue sources climbed just over $2 billion (or 4.5%).

As widely expected, federal funding is down this fiscal year. With all sources taken into account, Illinois’ general funds are up $650 million (or 1.5%) for the fiscal year through April.

CGFA broke down the year-to-date revenue numbers as follows:

Chart from the Commission on Government Forecasting and Accountability (CGFA).

Due to the higher tax receipts, CGFA increased its fiscal year 2025 total revenue estimate by $317 million to almost $53.9 billion.

Despite revenues coming in stronger than last year, CGFA’s revenue estimate is still lower than the one Governor Pritzker based his budget on in February. Media reports indicate that there is a significant gap between Pritzker’s proposed budget for fiscal year 2026 and projected revenues.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles