August 11, 2025

Year-over-year, Illinois revenues fell by $35 million in July

Year-over-year, Illinois revenues dipped in July, according to a report by the Commission on Government Forecasting and Accountability (CGFA).

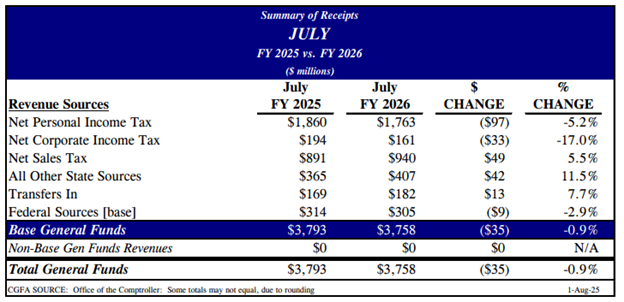

Calling it a “minor decrease,” the report noted that July deposits into the state’s general funds were down $35 million (-0.9%) from July 2024.

The decrease was driven by declines in personal income and corporate income taxes, somewhat offset by increases in sales taxes and other state revenues. (See chart below.)

Source: Chart from the CGFA.

Despite the initial decline, CGFA is projecting total general revenue funds to climb by 2.4% in FY 26.

The projected increase is driven by new taxes, a tax amnesty program, and “limited growth in its core receipts.”

The state’s fiscal year runs from July through June.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles