Topics:

January 3, 2023 Last Edit: June 5, 2025

Can Minnesota Be Very Cold and High Tax Forever?

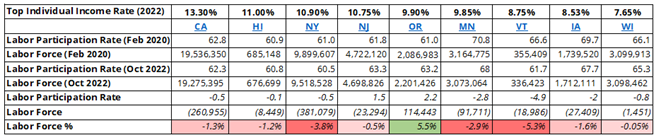

Eight of the nine highest individual income tax states experienced declines in the size of their labor force. Seven of the nine experienced declines in the labor force participation rate.

Oregon stands as the lone outlier, in part because they are one of the larger beneficiaries of the outflow from California. And despite a high top tax rate, Oregon’s overall state-local tax burden, according to the Tax Foundation, is far more favorable than California’s.

However, it’s not all wine and roses, as Oregon experienced a net total population decline from July 2021 to July 2022.

Notably, New York – a cold, high tax state – experienced even worse labor force decline than sunny, high tax California.

The labor force trend in these states adds to the worker shortage impacting small businesses there and across the country.

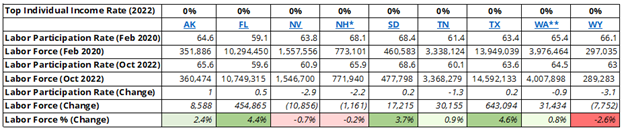

The second chart shows the same change as above, but in the nine states with no income tax, from February 2020 to October 2022.

Eight of the nine highest individual income tax states experienced declines in the size of their labor force. Seven of the nine experienced declines in the labor force participation rate.

Oregon stands as the lone outlier, in part because they are one of the larger beneficiaries of the outflow from California. And despite a high top tax rate, Oregon’s overall state-local tax burden, according to the Tax Foundation, is far more favorable than California’s.

However, it’s not all wine and roses, as Oregon experienced a net total population decline from July 2021 to July 2022.

Notably, New York – a cold, high tax state – experienced even worse labor force decline than sunny, high tax California.

The labor force trend in these states adds to the worker shortage impacting small businesses there and across the country.

The second chart shows the same change as above, but in the nine states with no income tax, from February 2020 to October 2022.

*NH taxes income from interest and dividends; **WA taxes income from capital gains

This shows a much different story than the high tax states. While labor force participation declined in five of the nine states, the labor force grew in six of the nine states – providing some buffer against the national trend of early retirements and other premature labor force exits during the pandemic.

The biggest gainers – Texas and Florida – were both warm, low tax states, while chilly, low tax South Dakota did ok too.

These charts are just a snapshot in time, and by no means a conclusive argument that Minnesota’s status as a high tax, very cold state is permanently perilous. Domestic migration is a complicated puzzle, with economically hospitable warm or mountainous states generally seeing some of the largest net gains in recent years.

To some extent, these changes are a continuation of pre-COVID19 pandemic trends (although some are a rapid acceleration during the pandemic). This is certainly the case with Oregon and Washington, which have benefited from those leaving California for some time.

Taxes and weather are just two factors in decisions about where to locate. But the high tax versus no tax comparison begs a lot of questions about the future of small business in these states.

The labor force trends also reflect larger population trends. Large cities like New York, Los Angeles and San Francisco saw some of the biggest net population declines during the pandemic.

Minnesota’s net population gain from July 2020 to July 2022 was only 7,300 people. According to the State Demographer, normal population growth is 35,000 to 40,000 people per year. (KARE11, 12/23/22)

The demographer attributes the paltry net gain to several factors, including low net birth rates and net losses in domestic migration. Low population growth is exacerbating hiring challenges, with 214,000 job openings but fewer than 100,000 people looking for work in Minnesota.

Minnesota’s population woes are only expected to get worse in coming years. Could making our state a more financially attractive place to live and work change the course?

Over the next few years, we’ll get an interesting comparison of what happens when one cold weather state cuts tax rates while another cold state remains a high tax haven.

Iowa – one of the high individual income tax states – is in the process of slashing tax rates for individuals and corporations. Soon, they will have a flat individual income tax of 3.9% – and possibly lower pending legislative action in 2023 – as well as a corporate rate of 5.5% and no taxes on most forms of retirement income.

Meanwhile, Gov. Walz and the new legislative majorities in Minnesota have taken a dim view of tax cuts. And some have suggested Minnesota look at raising new revenue since some advocates and politicians want to commit the $17.6 billion to new government spending.

*NH taxes income from interest and dividends; **WA taxes income from capital gains

This shows a much different story than the high tax states. While labor force participation declined in five of the nine states, the labor force grew in six of the nine states – providing some buffer against the national trend of early retirements and other premature labor force exits during the pandemic.

The biggest gainers – Texas and Florida – were both warm, low tax states, while chilly, low tax South Dakota did ok too.

These charts are just a snapshot in time, and by no means a conclusive argument that Minnesota’s status as a high tax, very cold state is permanently perilous. Domestic migration is a complicated puzzle, with economically hospitable warm or mountainous states generally seeing some of the largest net gains in recent years.

To some extent, these changes are a continuation of pre-COVID19 pandemic trends (although some are a rapid acceleration during the pandemic). This is certainly the case with Oregon and Washington, which have benefited from those leaving California for some time.

Taxes and weather are just two factors in decisions about where to locate. But the high tax versus no tax comparison begs a lot of questions about the future of small business in these states.

The labor force trends also reflect larger population trends. Large cities like New York, Los Angeles and San Francisco saw some of the biggest net population declines during the pandemic.

Minnesota’s net population gain from July 2020 to July 2022 was only 7,300 people. According to the State Demographer, normal population growth is 35,000 to 40,000 people per year. (KARE11, 12/23/22)

The demographer attributes the paltry net gain to several factors, including low net birth rates and net losses in domestic migration. Low population growth is exacerbating hiring challenges, with 214,000 job openings but fewer than 100,000 people looking for work in Minnesota.

Minnesota’s population woes are only expected to get worse in coming years. Could making our state a more financially attractive place to live and work change the course?

Over the next few years, we’ll get an interesting comparison of what happens when one cold weather state cuts tax rates while another cold state remains a high tax haven.

Iowa – one of the high individual income tax states – is in the process of slashing tax rates for individuals and corporations. Soon, they will have a flat individual income tax of 3.9% – and possibly lower pending legislative action in 2023 – as well as a corporate rate of 5.5% and no taxes on most forms of retirement income.

Meanwhile, Gov. Walz and the new legislative majorities in Minnesota have taken a dim view of tax cuts. And some have suggested Minnesota look at raising new revenue since some advocates and politicians want to commit the $17.6 billion to new government spending.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

February 5, 2026

NFIB Urges Arizona State Lawmakers to Align State Tax Code with Department of Revenue’s Forms

With tax filing season underway, small business owners need certainty now

Read More

February 4, 2026

Illinois Year-over-Year Tax Collections Climb Further in January

Federal transfers are down for the year, partially offsetting record collections in Illinois

Read More

February 3, 2026

NFIB Comment Ahead of Governor Lamont’s State of the State Address

Connecticut’s small business owners need more than one-time rebates to thrive — they need long-term, structural tax reforms

Read More

February 3, 2026

VA Tax Bills Would Drive Up Costs for VA Small Businesses and Families

Some lawmakers are eyeing new taxes despite a state budget surplus.

Read More