Small Business Optimism Index

Small Business Optimism Index

Overview

The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since the 4th quarter of 1973 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in October 2025.

October 2025: Small Business Optimism Takes a Small Step Back as Uncertainty Eases in October

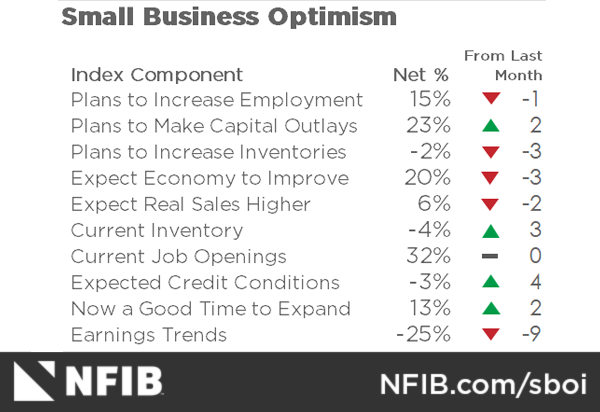

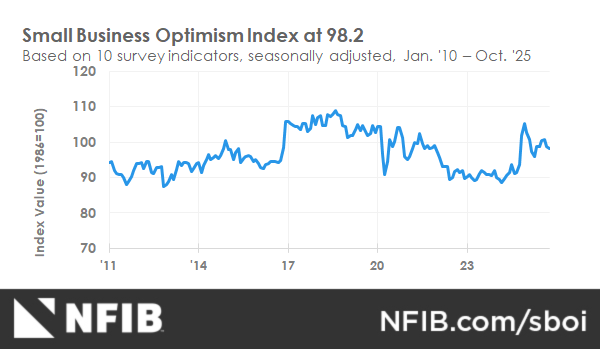

The NFIB Small Business Optimism Index declined 0.6 points in October to 98.2 but remained above its 52-year average of 98. The Uncertainty Index fell 12 points from September to 88, the lowest reading of this year.

Optimism among small businesses declined slightly in October as owners report lower sales and reduced profits. Additionally, many firms are still navigating a labor shortage and want to hire but are having difficulty doing so, with labor quality being the top issue for Main Street.

NFIB Chief Economist Bill Dunkelberg

In conjunction with the October report, NFIB is also debuting a new podcast: “Small Business by the Numbers” – this is the NFIB Research Center’s new podcast where we discuss everything related to the small business economy. Guests and host Holly Wade, the Executive Director of the NFIB Research Center, will discuss the data, stories, and economic conditions affecting small businesses nationwide. Listen to the intro episode here.

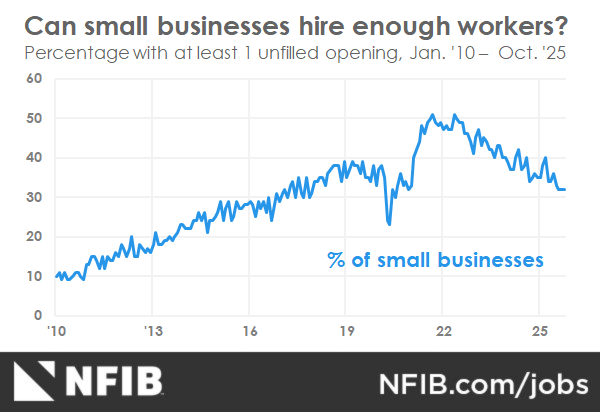

Thirty-two percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, unchanged for the second consecutive month. Before August, the last time unfilled job openings hit 32% was in December 2020.

In October, 27% of small business owners cited labor quality as their single most important problem, up 9 points from September and the highest level since the record high of 29% in November 2021. Labor quality ranked as the top problem and was 11 points higher than taxes, which ranked second.

In October, 27% of small business owners cited labor quality as their single most important problem, up 9 points from September and the highest level since the record high of 29% in November 2021. Labor quality ranked as the top problem and was 11 points higher than taxes, which ranked second.

A net negative 13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 6 points from September.

A net negative 13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 6 points from September.

The frequency of reports of positive profit trends fell 9 points from September to a net negative 25% (seasonally adjusted). This component contributed the greatest to the decline in the Optimism Index.

The frequency of reports of positive profit trends fell 9 points from September to a net negative 25% (seasonally adjusted). This component contributed the greatest to the decline in the Optimism Index.

In October, both actual and planned price increases fell from the previous month. The net percent of owners raising average selling prices fell 3 points from September to a net 21% (seasonally adjusted). Looking forward to the next three months, a net 30% (seasonally adjusted) plan to increase prices (down 1 point from September).

In October, both actual and planned price increases fell from the previous month. The net percent of owners raising average selling prices fell 3 points from September to a net 21% (seasonally adjusted). Looking forward to the next three months, a net 30% (seasonally adjusted) plan to increase prices (down 1 point from September).

The net percent of owners reporting inventory gains fell 3 points to a net negative 6% (seasonally adjusted). Not seasonally adjusted, 10% reported increases in stocks (unchanged), and 15% reported reductions (up 3 points).

The net percent of owners reporting inventory gains fell 3 points to a net negative 6% (seasonally adjusted). Not seasonally adjusted, 10% reported increases in stocks (unchanged), and 15% reported reductions (up 3 points).

In October, 60% of small business owners reported that supply chain disruptions were affecting their business to some degree, down 4 points from September.

In October, 60% of small business owners reported that supply chain disruptions were affecting their business to some degree, down 4 points from September.

The net percent of owners expecting better business conditions fell 3 points from September to a net 20% (seasonally adjusted), the lowest level since April but remaining above the historical average of net 4%.

The net percent of owners expecting better business conditions fell 3 points from September to a net 20% (seasonally adjusted), the lowest level since April but remaining above the historical average of net 4%.

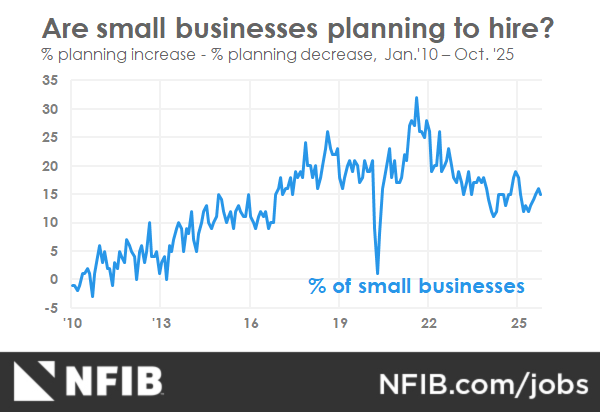

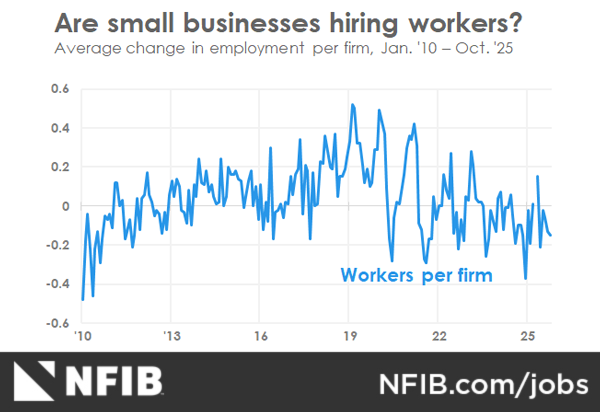

As reported in NFIB’s monthly jobs report, a seasonally adjusted 32% of all small business owners reported job openings they could not fill in October, unchanged for the second consecutive month. Before August, the last time unfilled job openings hit 32% was in December 2020. Of the 56% of owners hiring or trying to hire in October, 88% reported few or no qualified applicants for the positions they were trying to fill. A seasonally adjusted net 15% of owners plan to create new jobs in the next three months, down 1 point from September. This marks the first decline since hiring plans started to increase in May 2025.

Labor costs reported as the single most important problem for business owners fell by 3 points from September to 8%. Seasonally adjusted, a net 26% reported raising compensation, down 5 points from September. A seasonally adjusted net 19% plan to raise compensation in the next three months, unchanged from September.

Fifty-five percent of small business owners reported capital outlays in the last six months, down 1 point from September. Of those making expenditures, 36% reported spending on new equipment, 22% acquired vehicles, and 14% improved or expanded facilities. Thirteen percent spent money on new fixtures and furniture and 3% acquired new buildings or land for expansion. Twenty-three percent (seasonally adjusted) plan capital outlays in the next six months, up 2 points from September.

A net negative 13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 6 points from September. The net percent of owners expecting higher real sales volumes fell 2 points from September to a net 6% (seasonally adjusted).

The net percent of owners reporting inventory gains fell 3 points to a net negative 6%, seasonally adjusted. Not seasonally adjusted, 10% reported increases in stocks, and 15% reported reductions. A net negative 4% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in October, up 3 points from September’s largest monthly decline in the survey’s history. A net negative 2% (seasonally adjusted) of owners plan inventory investment in the coming months, down 3 points from September.

In October, both actual and planned price increases fell from the previous month. The net percent of owners raising average selling prices fell 3 points from September to a net 21% (seasonally adjusted). Despite the decline, price increases remain above the monthly average of a net 13%, suggesting continued inflationary pressure.

Unadjusted, 31% reported higher average prices (down 2 points), and 12% reported lower average selling prices (up 2 points). Looking forward to the next three months, a net 30% (seasonally adjusted) plan to increase prices (down 1 point from September).

The frequency of reports of positive profit trends fell 9 points from September to a net negative 25% (seasonally adjusted). This component contributed the greatest to the decline in the Optimism Index. Among owners reporting lower profits, 33% blamed weaker sales, 16% cited the rise in the cost of materials, 9% cited price change for their product(s) or service(s), and 9% cited labor costs. Among owners reporting higher profits, 53% cited sales volume, 17% cited usual seasonal change, and 11% cited higher selling prices.

A net 5% reported their last loan was harder to get than in previous attempts, down 2 points from September’s highest reading of this year. In October, a net 1% of owners reported paying a higher interest rate on their most recent loan, down 6 points from September. The average rate paid on short maturity loans was 8.7% in October, down 0.1 points from September. Twenty-three percent of all owners reported borrowing on a regular basis, down 3 points from September.

In October, owners’ overall assessment of their business’ health declined from the previous month as more owners reported it as “fair” than “good”. When asked to evaluate the overall health of their business, 12% reported it as excellent (up 1 point), and 51% reported it as good (down 6 points). Thirty-three percent reported the health of their business as fair (up 6 points), and 4% reported it as poor (unchanged).

The net percent of owners expecting better business conditions fell 3 points from September to a net 20% (seasonally adjusted), the lowest level since April but remaining above the historical average of net 4%.

In October, 13% (seasonally adjusted) reported that it is a good time to expand their business, up 2 points from September. Compared to readings during economic expansions, this is a relatively weak reading.

Twenty-seven percent of small business owners reported labor quality as their single most important problem, up 9 points from September and ranking as the top problem. The percent of small business owners reporting labor costs as their single most important problem fell 3 points to 8%.

Twelve percent of owners reported that inflation was their single most important problem in operating their business, down 2 points from September.

The percent of small business owners reporting poor sales as their top business problem remained at 10%.

In October, 8% reported the cost or availability of insurance as their single most important problem, unchanged from September. Two percent reported that financing and interest rates was their top business problem in October, down 2 points from September.

Five percent reported competition from large businesses as their single most important problem, unchanged from September.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in October 2025.

Labor Market

In October, 32% (seasonally adjusted) of all owners reported job openings they could not fill in the current period, unchanged for the second consecutive month. Before August, the last time unfilled job openings hit 32% was in December 2020. Twenty-eight percent had openings for skilled workers (unchanged from September), and 11% had openings for unskilled labor (down 2 points). A seasonally adjusted net 15% of owners plan to create new jobs in the next three months, down 1 point from September. This marks the first decline since hiring plans started to increase in May 2025. Overall, 56% reported hiring or trying to hire in October, down 2 points from September. Forty-nine percent (88% of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (down 1 point). Thirty-one percent of owners reported few qualified applicants for their open positions (up 2 points), and 18% reported none (down 3 points). The last 12 months show clear movement towards a somewhat easier hiring environment, as the percent reporting “few” has strongly exceeded the percent reporting “none.” In October, 27% of small business owners cited labor quality as their single most important problem, up 9 points from September and the highest level since the record high of 29% in November 2021. Labor quality ranked as the top problem and was 11 points higher than taxes which ranked second. Labor quality reported as the single most important problem was the highest in the construction, transportation, and professional services industries, and lowest in finance and agriculture. Nearly half (49%) of small businesses in the construction industry reported labor quality as their single most important problem, 22 points higher than for all firms.

Capitol Spending

Fifty-five percent of small business owners reported capital outlays in the last six months, down 1 point from September. Of those making expenditures, 36% reported spending on new equipment (down 6 points), 22% acquired vehicles (unchanged), and 14% improved or expanded facilities (unchanged). Thirteen percent spent money on new fixtures and furniture (up 2 points), and 3% acquired new buildings or land for expansion (down 2 points). Twenty-three percent (seasonally adjusted) plan capital outlays in the next six months, up 2 points from September. A bit anemic overall however.

Inflation

In October, both actual and planned price increases fell from the previous month. The net percent of owners raising average selling prices fell 3 points from September to a net 21% (seasonally adjusted). Despite the decline, price increases remain above the monthly average of a net 13%, suggesting continued inflationary pressure. Unadjusted, 31% reported higher average prices (down 2 points), and 12% reported lower average selling prices (up 2 points). Looking forward to the next three months, a net 30% (seasonally adjusted) plan to increase prices (down 1 point from September). Twelve percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), down 2 points from September.

Credit Markets

A net 5% reported their last loan was harder to get than in previous attempts, down 2 points from September’s highest reading of this year. In October, a net 1% of owners reported paying a higher interest rate on their most recent loan, down 6 points from September. The average rate paid on short maturity loans was 8.7% in October, down 0.1 points from September. Twenty-three percent of all owners reported borrowing on a regular basis, down 3 points from September.

Compensation and Earnings

Seasonally adjusted, a net 26% reported raising compensation, down 5 points from September. A seasonally adjusted net 19% plan to raise compensation in the next three months, unchanged from September. The frequency of reports of positive profit trends fell 9 points from September to a net -25% (seasonally adjusted). This component contributed the greatest to the decline in the Optimism Index. Among owners reporting lower profits, 33% blamed weaker sales, 16% cited the rise in the cost of materials, 9% cited price change for their product(s) or service(s), and 9% cited labor costs. Among owners reporting higher profits, 53% cited sales volume, 17% cited usual seasonal change, and 11% cited higher selling prices.

Sales and Inventories

A net -13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 6 points from September. The net percent of owners expecting higher real sales volumes fell 2 points from September to a net 6% (seasonally adjusted). The net percent of owners reporting inventory gains fell 3 points to a net -6% (seasonally adjusted). Not seasonally adjusted, 10% reported increases in stocks (unchanged), and 15% reported reductions (up 3 points). A net -4% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in October, up 3 points from September’s largest monthly decline in the survey’s history. A net -2% (seasonally adjusted) of owners plan inventory investment in the coming months, down 3 points from September. In October, 60% of small business owners reported that supply chain disruptions were affecting their business to some degree, down 4 points from September. Four percent reported a significant impact (down 1 point), 17% reported a moderate impact (down 1 point), 39% reported a mild impact (down 2 points), and 39% reported no impact (up 4 points).

Outlook

In October, overall business health declined from the previous month as fewer owners reported it as good and more reported it as fair. When asked to evaluate the overall health of their business, 12% reported it as excellent (up 1 point), and 51% reported it as good (down 6 points). Thirty-three percent reported the health of their business as fair (up 6 points), and 4% reported it as poor (unchanged). The net percent of owners expecting better business conditions fell 3 points from September to a net 20% (seasonally adjusted), the lowest level since April but remaining above the historical average of net 4%. In October, 13% (seasonally adjusted) reported that it is a good time to expand their business, up 2 points from September. Compared to readings during economic expansions, this is a relatively weak reading.

Single Most Important Problem

In October, labor quality ranked as the top problem for small business owners and was 11 points higher than taxes which ranked second. The percent of small business owners reporting labor quality as the single most important problem for their business rose 9 points from September to 27%. This was the highest level since the record high of 29% in November 2021. Labor costs reported as the single most important problem for business owners fell 3 points from September to 8%. Sixteen percent of small business owners reported taxes as their single most important problem, down 2 points from September and ranking as the second top problem. The percent of small business owners reporting government regulations and red tape as their single most important problem rose 1 point to 7%. Twelve percent of owners reported that inflation was their single most important problem in operating their business, down 2 points from September. The percent of small business owners reporting poor sales as their top business problem remained at 10%. In October, 8% reported the cost or availability of insurance as their single most important problem, unchanged from September. Two percent reported that financing and interest rates was their top business problem in October, down 2 points from September. Five percent reported competition from large businesses as their single most important problem, unchanged from September.

Commentary

Overview

Uncertainty, while lower than in September, remained high. The upcoming elections (Oct. Survey) and government shutdown likely played a role. Small business owners were reasonably optimistic at the start of the year (Optimism Index at 102.8), but it has been a downhill slide through the last nine or so months with the current reading closing in on the 52-year average of 98. Foreign policy dominates the headlines, with a focus on tariff policy, raising lots of consternation about the cost of inputs and pressures to raise prices. Sales were not strong, and profits took a hit in the third quarter; lots of owners reported profit declines.

Attempts to hire and fill open positions met with little success, leaving job growth negligible even though compensation raised remains above the historical average. The shutdown will depress wage growth as many government employees won’t get paid. Much of the missed pay will be disbursed once the shutdown is over, but until then, life will be difficult for many. This will directly and indirectly impact some small businesses.

The shutdown will be resolved by year-end, hopefully sooner, but until then our economic measures will show weak economic growth expectations, slowing sales, and weak job growth. Owners are resilient but it won’t be pleasant until the shutdown is ended and the government gets back to business.

Quotes from NFIB Members

“Government continues to put more financial pressure on the construction business. There are more regulations and higher OSHA fines against the people who actually build this country.” – Construction, OR

“It is becoming increasingly difficult to provide medical insurance that the company and employees can afford.” – Manufacturing, OH

“The cost of health insurance goes up every year since ACA, and no small business can keep up with the costs. This increase will surely kill many small businesses in the next couple of years. Soon I will no longer be able to offer health insurance to my employees. In turn this will cost me good employees.”- Manufacturing, PA

“As usual, taxes at the county and state level are always rising, however our prices to sell our goods remain similar to last year as consumers are struggling (in this state) with the same tax burdens.” – Agriculture, WA

“Expecting an economic slowdown due to interest rates still being relatively high.” – Construction, MT