What it means: Two new digital tools are available on NFIB’s website to provide real data on what will happen if the 20% Small Business Tax Deduction expires. Check out the new interactive map and tax calculator to see what losing the deduction would mean for your small business and local economy.

Our take: “These new tools put real data in the hands of small business owners, policymakers, and the public. They make it clear what’s at stake if Congress fails to act: fewer jobs, less investment, and slower economic growth in communities across America. Congress must act now to make the 20% Small Business Tax Deduction permanent,” said NFIB President Brad Close.

Take Action: Join the fight alongside NFIB members meeting with lawmakers on Capitol Hill. Amplify their voice during the Week of Action June 9-13 and take action!

As the expiration deadline nears for a massive tax hike on nine out of 10 small businesses, NFIB launched two new digital tools as a resource to explore the consequences if Congress fails to make the 20% Small Business Tax Deduction permanent. The deduction was created to level the playing field between small businesses and larger corporations, and these tools show the positive impact of the deduction with real data.

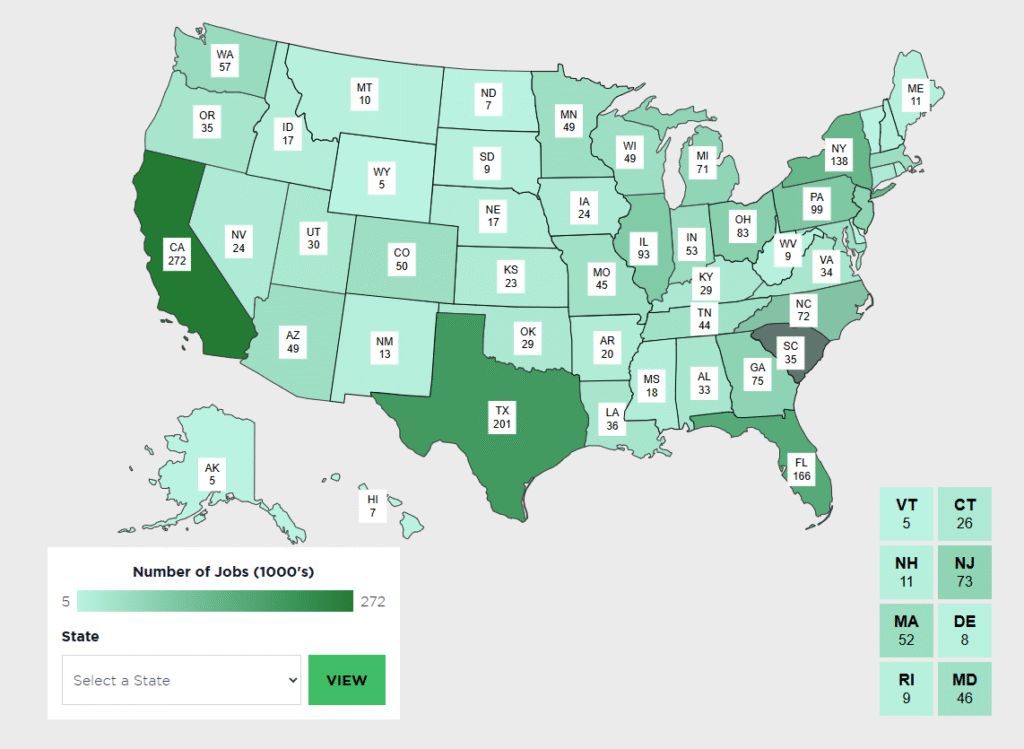

The new tools include an interactive map that provides both a statewide and district-level view of how the deduction, when made permanent, will continue to support local economies. State leaders can assess the overall impact in their state, while small business owners can see what it means for their communities. The map breaks down projected job creation and GDP growth that could result from making the deduction permanent.

There is also a tax calculator that gives small business owners a clearer picture of how they personally could be impacted if the deduction expires. By entering basic information such as filing status, personal income, and qualified business income, users can see side-by-side comparisons of their estimated tax burden under two scenarios: if the Tax Cuts and Jobs Act (TCJA) is extended and if it is not.

To explore the interactive tools and learn more about NFIB’s advocacy to protect small businesses, visit: www.SmallBusinessDeduction.com. TAKE ACTION: Urge your legislators to make the 20% Small Business Tax Deduction Permanent.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles