Topics:

April 3, 2023 Last Edit: June 5, 2025

Last month's tornadoes devastated communities in Arkansas, Tennessee, Illinois, Indiana, Alabama and Mississippi

What You Need to Know About Filing an Insurance Claim for Your Small Business

After the storm passes, call your insurance company.

At a minimum, you’ll want to ask:- What types of damage are covered?

- How long will it take to process my claim?

- Will I need to obtain estimates for repairs?

Make temporary repairs.

While it’s OK to take steps to protect your property from further damage, you should hold off on making extensive permanent repairs until the claims adjuster (a person professionally trained to assess the damage) has visited your business and assessed the damages. Make sure you save receipts for what you spend on repairs.Prepare for the adjuster’s visits.

The more information you have about your damaged property ––descriptions of as many items as possible, approximate date of purchase and what it would cost to replace or repair them––the faster your claim can be settled.- To substantiate your loss, prepare an inventory of damaged or destroyed items and give a copy to the adjuster, along with copies of any receipts. Don’t throw out damaged items until the adjuster has visited. You should also consider photographing or videotaping the damage. If your property was destroyed, or you no longer have any records, work from memory.

- Identify structural damage to your business and any supporting structures. Make a list of everything you want to show the adjuster, such as cracks in the walls and missing roof tiles. You should also get the electrical system checked. Most insurance companies pay for these inspections.

- Get written bids from licensed contractors. The bids should include details of the materials to be used and prices on a line-by-line basis. This makes adjusting the claim faster and simpler.

- Keep copies of the lists and other documents you submit to your insurance company. Also, keep copies of whatever paperwork your insurance company gives you and record the names and phone numbers of everyone to whom you speak.

After your claim has been settled and the repair work is underway.

Take the time to re-evaluate your insurance coverage. Was your business adequately insured? Did you have replacement cost coverage for all of your assets? Talk to your insurance agent about possible changes.

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

February 5, 2026

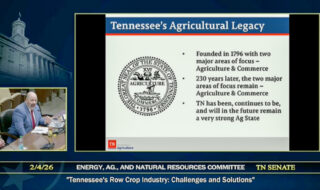

State Hearing Delves into Challenges, Opportunities for Row Crop Farmers

Witnesses warn of mounting losses and infrastructure barriers threatening farms.

Read More

January 28, 2026

Join Us for Small Business Day at the Capitol on Feb. 19

This is a great opportunity to speak out on the issues affecting your small business.

Read More

January 26, 2026

Illinois January Legislative Recap

Illinois legislators didn’t advance any meaningful legislation in January

Read More

January 23, 2026

Gov. Ivey Declares State of Emergency Ahead of Winter Storm

The proclamation affects 19 counties across northern Alabama.

Read More