June 17, 2024 Last Edit: June 5, 2025

NFIB members from across Massachusetts traveled to the 2024 NFIB Fly-In in Washington, DC to learn more about the federal policies impacting their businesses and visit with elected officials. The group of Bay State employers advocated to make the twenty-percent small business deduction from the 2017 Tax Cuts and Jobs Act permanent and called for a repeal of the harmful beneficial ownership reporting requirement.

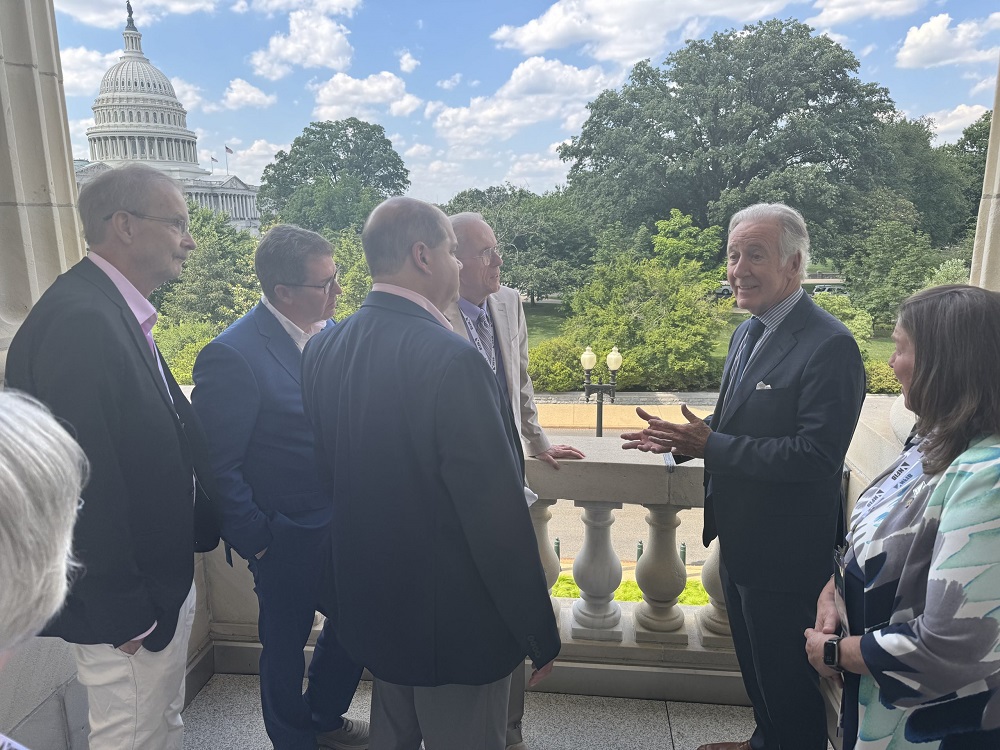

The group of business owners met with Congressman Jim McGovern, the office of Congressman Jake Auchincloss, and Congressman Richard Neal (seen talking with NFIB members in the Capitol in the picture below). Each employer related a story on how their tax savings from the current twenty-percent deduction was used to reinvest in their small business. Whether it meant increasing employee wages, creating a 401k match, or purchasing new equipment, the tax savings helped to grow those businesses and the need to make the deduction permanent was stressed to lawmakers.

Other conversations included how the beneficial ownership reporting requirement is not just a huge government overreach for employers, but for workers who have control over the business. This new requirement doesn’t just mean penalties and potential jailtime for business owners that fail to register, but the ambiguity of the law results in managers or other workers with substantial control to register as well. Making matters worse, many business owners are still unfamiliar with this requirement that must be completed by the end of the year.

In the end, the business owners from Massachusetts were excellent representatives for the membership and relayed impactful stories to lawmakers on both pieces of legislation.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles