Topics:

February 20, 2023

NFIB-Backed Independent Contractor Bill Passes Senate

State Director Ronda Wiggers reports from Helena on the small-business agenda for the legislative and political week ending February 17

The Legislature likely did not gain as much ground as they should have this week. If the tracking numbers are correct, they are likely to need to have hearings and take action on over 400 bills in the next seven working days in order to meet transmittal deadlines. Next week’s hearing schedule is filling up quickly and will have hearings added with very short notice. Day 45 of the Legislative Session marks the ‘transmittal deadline’ for general bills. That means that all bills that do not deal with money must have passed through their first chamber, or they die. That day will be next Friday, March 3. However, in order to meet that deadline, they must be introduced by this Friday, March 24, have a hearing, a vote of the committee and then both second and third readings on the floor. Basically, they are running out of time for any ideas that are not already in the process. The Week in Review The full Senate debated and passed SB 216, a tort reform bill being brought forward that among other things, attempts to protect retailers from product liability if they did not alter, assemble or manufacture the product and had no way of knowing there could be a defect or unsafe condition. NFIB testified in favor of this bill.- HB 386, which would establish a requirement for paid sick days, was TABLED in the House Business & Labor Committee.

- HB 212, which would increase the business equipment tax exemption from $300,000 to $1 million was heard in Senate Tax and passed 2nd reading on the Senate floor. Because it reduces the amount of taxes that will be collected and affects the state budget, it now will go to Senate Finance and Claims to have a budget hearing next week.

- HB 389, which would create a mini-COBRA law for small employer health insurance plans was TABLED in the House Business & Labor Committee.

- SB 22, which would revise independent contractor laws. The Senate Business & Labor Committee added the amendments supported by NFIB and passed the bill from committee. It passed the Senate floor later in the week and is headed to the House. The intent is to clarify that if a business did all the right things to determine that they were hiring an IC to do work, and that IC certificate had expired for some reason, the business would not be liable for employment taxes and workers’ compensation.

- SB 270, which would prohibit employee termination for legal social media posts. This only applies to personal social media accounts, not those intended for business related purposes. The ability to terminate if an employee uses social media to disclose trade secrets, releases proprietary, confidential or financial data, or conducts criminal defamation remains in the law. This bill was heard in the Senate Business & Labor Committee where it was amended to be a little more employer friendly and then it passed the Senate floor later in the week.

- HB 636 would revise workers’ compensation laws relating to exemptions from the act. This bill proposes to lower the percentage of ownership a business owner needs to have in order to opt out of workers’ compensation insurance from 20% to 10%

- HB 651 would establish the Montana family and medical leave insurance act. The computer system used by the legislature has not uploaded the introduced version of these recently introduced bills, so we do not have any language at this time.

- HB 652 would revise unemployment insurance law relating to benefit duration. Language is not currently available for this bill. However, the sponsor indicated that he is removing the lengthier benefit time frames that are in place for long-term employees who lose their jobs.

- HB 658 would generally revise card transaction fees. Language is not currently available for this bill. The sponsor indicated that he wants to make it clearly legal for a business to charge a fee for customers using a credit card unless specifically prohibited in their credit card agreement.

- SB 95 would generally revise theft laws that address theft and bad checks. The measure has finally passed the Senate!! Corrections added a pretty hefty fiscal note to prosecute and offer public defenders. NFIB argued that either we go back to the previous law and the state pays for prosecuting theft or small businesses, and in turn, their customers, pay for the theft. One method should decrease the amount of petty theft and bad checks, the other encourages the behavior.

- LC 1762 would revise workers’ compensation definition of wages related to lodging. This is proposing to increase the rate paid annually according to inflation.

- LC 2522 would revise workers’ compensation laws relating to designation of treating physician. This draft is in legal review and there is currently no language available.

- LC 3179 would revise workers compensation laws to increase benefits. This bill proposes to increase an injured worker’s benefits to 100% of their pay.

- LC 3495 would phase out use of Styrofoam in food-related businesses.

- LC 3693 would provide for a warehouse worker protection act. This is a bill that appears to be aimed at Amazon, but cut down to Montana size.

- LC 3945 and LC 4577 would generally revise workers’ compensation laws. Only the second bill has language available at this time. This proposal covers a number of issues in workers’ compensation.

- February 10—Bill Raising State’s Minimum Wage Rate Shelved

- February 3—House Passes Comprehensive Tax Package

- January 13—UI Theft and Penalties Bill Passes House

- January 4—Small Business Day in Helena, January 18

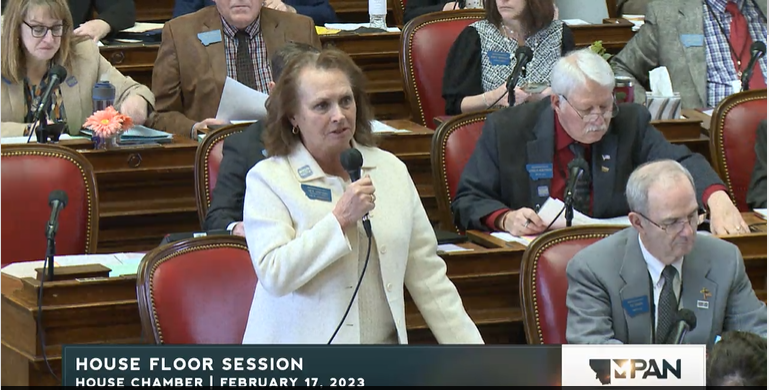

Photo snip courtesy of the Montana Public Affairs Network

Photo snip courtesy of the Montana Public Affairs Network

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

June 30, 2025

NFIB Slams MA Legislature for Slipping New “Secure Choice…

“Again, lawmakers’ policy choices and pro-small-business rhetoric are in…

Read More

June 30, 2025

Get Tips on Website ADA Compliance on the Small Business Rundow…

The Small Business Rundown talks website ADA compliance, the Small Business…

Read More

June 30, 2025

Small Business Annual Report Reminder

Information for Pennsylvania small business owners

Read More

June 27, 2025

Supreme Court Fails to Limit Unaccountable Delegations of Power

NFIB is discouraged by the decision today in the case Federal Communication…

Read More