July 29, 2024

RetireReady NJ holding four informational webinars over the next month

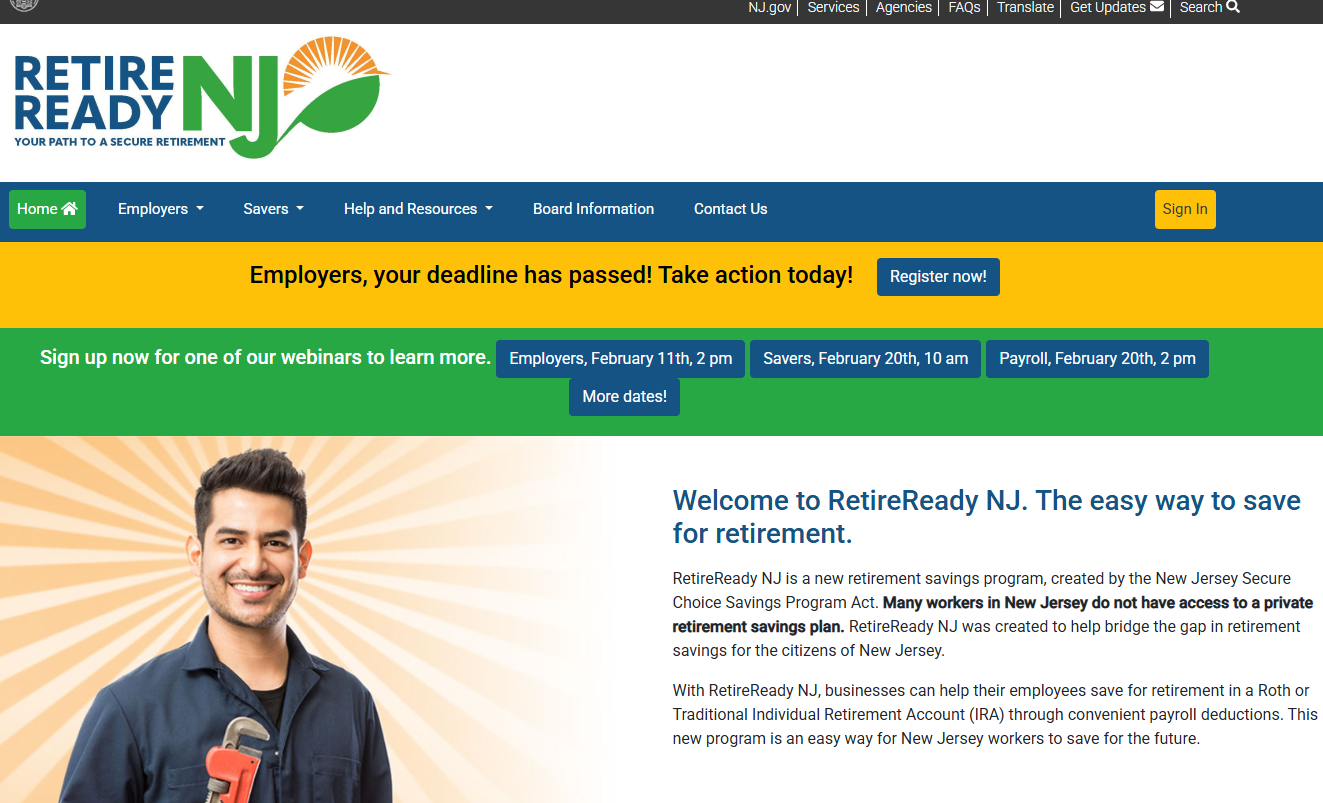

(Article update, Feb. 17, 2025) The New Jersey Secure Choice Savings Program Act was signed into law in 2019 and launched last summer as “RetireReady NJ.” It is a state-administered retirement savings program that aims to reach workers who do not have access to private employer retirement plans.

New Jersey businesses with 25 or more employees that have been in business for two years or more and do not currently offer a qualified retirement plan will be required to register with the program. Employees will be given the opportunity to begin saving for retirement through convenient payroll deductions into a Roth or Traditional Individual Retirement Account (IRA). Individuals who work for other employers or who are self-employed will also be able to save directly with RetireReady NJ. There is no cost for employers to participate in the program. Payroll deductions are easily integrated into an employer’s existing payroll system, making participation simple and convenient.

Mailers with detailed information about the program were sent to covered employers in July of 2024. Additionally, RetireReady NJ has continued to host a recurring series of informational webinars for employers to learn more about the program, its benefits, and key deadlines and requirements. Employers can register for these webinars at RetireReady.nj.gov, where a calendar of upcoming sessions is regularly updated. Recordings of previous webinars are also available at the website for viewing.

>>> For more information about RetireReady NJ, go HERE.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles