Small Business Optimism Index

Small Business Optimism Index

Overview

The NFIB Research Foundation has collected Small Business Economic Trends data with quarterly surveys since the 4th quarter of 1973 and monthly surveys since 1986. Survey respondents are drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in May 2025.

May 2025: Small Business Optimism Increases in May

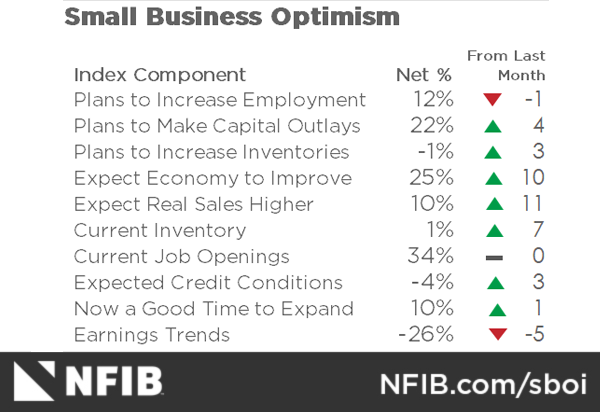

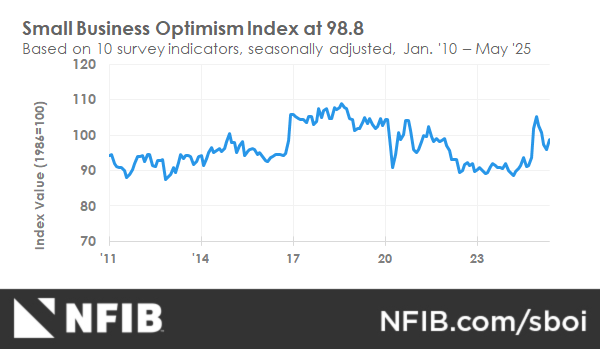

The NFIB Small Business Optimism Index increased by three points in May to 98.8, slightly above the 51-year average of 98. Expected business conditions and sales expectations contributed the most to the rise in the index. The Uncertainty Index rose two points from April to 94. Eighteen percent of small business owners reported taxes as their single most important problem, up two points from April and ranking as the top problem. The last time taxes were ranked as the top single most important problem was in December 2020.

Although optimism recovered slightly in May, uncertainty is still high among small business owners. While the economy will continue to stumble along until the major sources of uncertainty are resolved, owners reported more positive expectations on business conditions and sales growth.

NFIB Chief Economist Bill Dunkelberg

A net 1% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in May, up 7 points from April and the highest reading since August 2022. This was the largest monthly increase in the survey’s history.

The net percent of owners expecting better business conditions rose 10 points from April to a net 25% (seasonally adjusted).

The net percent of owners expecting better business conditions rose 10 points from April to a net 25% (seasonally adjusted).

The net percent of owners expecting higher real sales volumes rose 11 points from April to a net 10% (seasonally adjusted). This component contributed the most to the Optimism Index’s improvement.

The net percent of owners expecting higher real sales volumes rose 11 points from April to a net 10% (seasonally adjusted). This component contributed the most to the Optimism Index’s improvement.

Twenty-two percent (seasonally adjusted) plan capital outlays in the next six months, up four points from April and the highest reading of this year.

Twenty-two percent (seasonally adjusted) plan capital outlays in the next six months, up four points from April and the highest reading of this year.

The percent of small business owners reporting labor quality as the single most important problem for business fell three points from April to 16%.

The percent of small business owners reporting labor quality as the single most important problem for business fell three points from April to 16%.

Fourteen percent of owners reported that inflation was their single most important problem in operating their business, unchanged from April.

Fourteen percent of owners reported that inflation was their single most important problem in operating their business, unchanged from April.

When asked to rate the overall health of their business, 14% reported excellent (up one point), and 55% reported good (down one point). Twenty-eight percent reported the health of their business was fair (up one point) and 4% reported poor (unchanged).

When asked to rate the overall health of their business, 14% reported excellent (up one point), and 55% reported good (down one point). Twenty-eight percent reported the health of their business was fair (up one point) and 4% reported poor (unchanged).

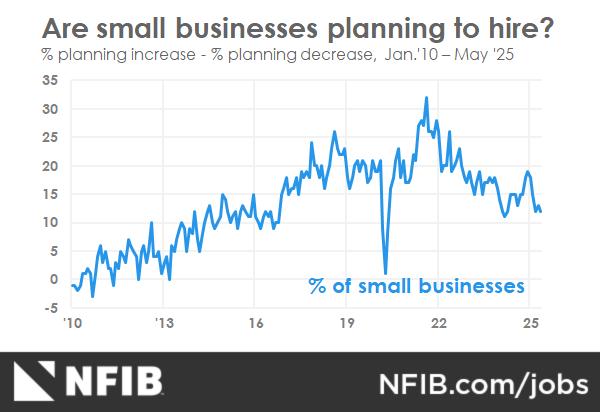

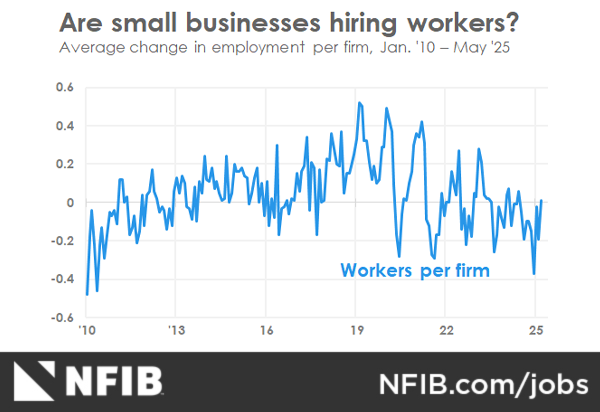

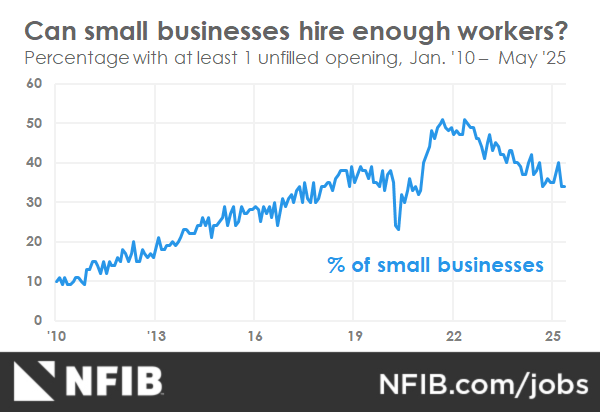

As reported in NFIB’s monthly jobs report, a seasonally adjusted 34% of all small business owners reported job openings they could not fill in May, unchanged from April. Of the 55% of owners hiring or trying to hire in May, 86% reported few or no qualified applicants for the positions they were trying to fill. A seasonally adjusted net 12% of owners plan to create new jobs in the next three months, down one point from April.

Labor costs reported as the single most important problem for business owners rose one point in May to 9%.

Seasonally adjusted, a net 26% reported raising compensation, down seven points from April. A seasonally adjusted net 20% plan to raise compensation in the next three months, up three points from April.

Fifty-six percent of owners reported capital outlays in the last six months, down two points from April and the lowest reading of this year.

Of those making expenditures, 40% reported spending on new equipment, 26% acquired vehicles, and 15% improved or expanded facilities. Ten percent spent money on new fixtures and furniture and 5% acquired new buildings or land for expansion.

In May, the percent of small business owners reporting poor sales as their top business problem remained at 9% for the fifth consecutive month. A net negative 13% of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down five points from April.

The net percent of owners reporting inventory gains was unchanged from April at a net negative 5%, seasonally adjusted. Not seasonally adjusted, 14% reported increases in stocks and 16% reported reductions. A net 1% (seasonally adjusted) of owners viewed current inventory stocks as “too low” in May, up seven points from April and the highest reading since August 2022.

Seasonally adjusted, a net 31% plan price hikes in May, up three points from April. The net percent of owners raising average selling prices was unchanged from April at a net 25%, seasonally adjusted. Unadjusted, 10% of owners reported lower average selling prices and 38% reported higher average prices.

The frequency of reports of positive profit trends was a net negative 26% (seasonally adjusted) in May, five points worse than in April. Among owners reporting lower profits, 36% blamed weaker sales, 13% cited the rise in the cost of materials, 11% cited usual seasonal change, and 8% cited labor costs. For owners reporting higher profits, 52% credited sales volumes, 27% cited usual seasonal change, and 8% cited higher selling prices.

Five percent of owners reported that financing and interest rates were their top business problem in May, up two points from April. Twenty-five percent of all owners reported borrowing on a regular basis, down one point from April. A net 4% reported their last loan was harder to get than in previous attempts, down one point from April. A net 7% reported paying a higher rate on their most recent loan, up one point from April.

Ten percent (seasonally adjusted) of owners reported that it is a good time to expand their business, up one point from April. Despite the increase, this remains a low reading historically.

Eighteen percent of small business owners reported taxes as their single most important problem, up two points from April and ranking as the top problem. The last time taxes were ranked as the top single most important problem was in December 2020, when it tied for first with labor quality. The percent of small business owners reporting government regulations and red tape as their single most important problem remained at 9%. Four percent reported competition from large businesses as their single most important problem, down three points from April.

The NFIB Research Center has collected Small Business Economic Trends data with quarterly surveys since the fourth quarter of 1973 and monthly surveys since 1986. Survey respondents are randomly drawn from NFIB’s membership. The report is released on the second Tuesday of each month. This survey was conducted in May 2025.

Labor Markets

In May, 34 percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, unchanged from April. The last time job openings were below 34 percent (seasonally adjusted) was in January 2021 (Covid recession). Thirty percent had openings for skilled workers (up 1 point) and 13 percent had openings for unskilled labor (unchanged for the fourth consecutive month). The difficulty in filling open positions is particularly acute in the construction, transportation, and manufacturing industries. Openings were the lowest in the wholesale and professional services industries. Job openings in construction were down 9 points from last month and down 6 points from May 2024. The percent of job openings in all reported industries except wholesale are lower, and significantly lower for most, from last year. A seasonally adjusted net 12 percent of owners plan to create new jobs in the next three months, down 1 point from April. Job creation plans remain in weak territory compared to recent history. Overall, 55 percent reported hiring or trying to hire in May, down 1 point from April. Forty-eight percent (86 percent of those hiring or trying to hire) of owners reported few or no qualified applicants for the positions they were trying to fill (up 1 point). Twenty-nine percent of owners reported few qualified applicants for their open positions (up 1 point) and 19 percent reported none (unchanged). The percent of small business owners reporting labor quality as the single most important problem for their business fell 3 points from April to 16 percent. The last time complaints about labor quality fell below 16 percent was in April 2020. Labor costs reported as the single most important problem for business owners rose 1 point from April to 9 percent.

Capitol Spending

Fifty-six percent reported capital outlays in the last six months, down 2 points from April and the lowest reading of this year. Of those making expenditures, 40 percent reported spending on new equipment (unchanged), 26 percent acquired vehicles (up 1 point), and 15 percent improved or expanded facilities (down 1 point). Ten percent spent money on new fixtures and furniture (down 4 points), and 5 percent acquired new buildings or land for expansion (down 1 point). Twenty-two percent (seasonally adjusted) plan capital outlays in the next six months, up 4 points from April and the highest reading of this year.

Inflation

The net percent of owners raising average selling prices was unchanged from April at a net 25 percent seasonally adjusted. Fourteen percent of owners reported that inflation was their single most important problem in operating their business (higher input costs), unchanged from April. The last time it was below 14 percent was in September 2021. Unadjusted, 10 percent (down 1 point) reported lower average selling prices and 38 percent (down 1 point) reported higher average prices. Price hikes were most frequent in the wholesale (68 percent higher, 4 percent lower), construction (45 percent higher, 8 percent lower), retail (41 percent higher, 6 percent lower), and services (38 percent higher, 5 percent lower) industries. Seasonally adjusted, a net 31 percent plan price hikes in May, up 3 points from April. Demand is still too strong to trigger widespread price reductions, but the economy is showing some signs of slowing.

Credit Markets

A net 4 percent reported their last loan was harder to get than in previous attempts, down 1 point from April. Five percent reported that financing and interest rates were their top business problem in May, up 2 points from April. A net 7 percent of owners reported paying a higher rate on their most recent loan, up 1 point from April. The average rate paid on short maturity loans was 8.7 percent, down 0.2 points from April. Twentyfive percent of all owners reported borrowing on a regular basis, down 1 point from April. High mortgage rates have slowed housing activity, a damper on GDP growth. But loan availability is good.

Compensation and Earnings

Seasonally adjusted, a net 26 percent reported raising compensation, down 7 points from April and the lowest reading since February 2021. This was the greatest monthly decline since April 2020. A seasonally adjusted net 20 percent plan to raise compensation in the next three months, up 3 points from April. Clearly, the pressure of labor costs on inflation is easing. The frequency of reports of positive profit trends was a net negative 26 percent (seasonally adjusted) in May, 5 points worse than in April. Among owners reporting lower profits, 36 percent blamed weaker sales, 13 percent cited the rise in the cost of materials, 11 percent cited usual seasonal change, and 8 percent cited labor costs. Among owners reporting higher profits, 52 percent cited sales volume, 27 percent cited usual seasonal change, and 8 percent cited higher selling prices.

Sales and Inventories

A net negative 13 percent of all owners (seasonally adjusted) reported higher nominal sales in the past three months, down 5 points from April. The net percent of owners expecting higher real sales volumes rose 11 points from April to a net 10 percent (seasonally adjusted). This component contributed the most to the Optimism Index’s increase. The net percent of owners reporting inventory gains was unchanged from April at a net negative 5 percent (seasonally adjusted). Not seasonally adjusted, 14 percent reported increases in stocks (up 1 point) and 16 percent reported reductions (down 1 point). A net 1 percent (seasonally adjusted) of owners viewed current inventory stocks as “too low” in May, up 7 points from April and the highest reading since August 2022. This was the largest monthly increase in the survey’s history. A net negative 1 percent (seasonally adjusted) of owners plan inventory investment in the coming months, up 3 points from April.

Commentary

The economy continues to grow (minus the hiccup in Q1), and GDP growth models indicate that it will continue to do so, although at a much slower pace. The services sector (labor intensive) is showing some weakness by way of the ISM Services Index. Congress hasn’t passed the Big Beautiful Bill yet, and Trump is still messing with tariffs, the uncertainty level is rising. While tariffs might be a bumpy road while countries negotiate trade deals, Congress can do their part by passing the BBB sooner rather than later to take that piece of uncertainty off the table. The labor market is softening, including compensation pressures. The prospects for strong future job growth are not great. Overall, the economy will continue to stumble along until the major sources of uncertainty are resolved. It’s hard to steer a ship in the fog.