Topics:

April 4, 2023 Last Edit: June 5, 2025

$18 Billion Surplus Not Enough for Gov. Walz, DFL Lawmakers

Look Out Minnesota, Here Come the Tax Hikes

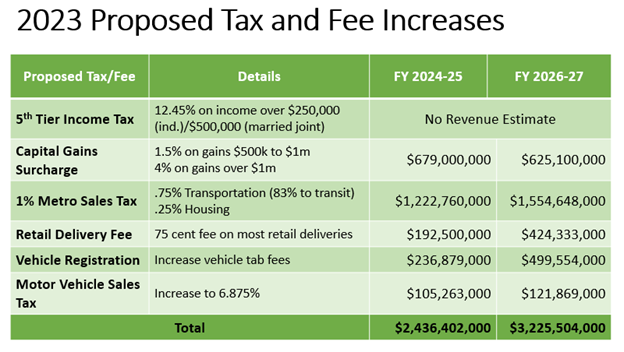

Among the new proposals are a 75-cent retail delivery fee and a combined 1% metro-area sales tax increase.

In total, five new taxes and fees under consideration will increase costs for businesses and consumers by $5.6 billion in the next four years. And we haven’t even gotten to the actual tax bill yet.

Notably, most of the new sales tax revenue will go to metro area transit (buses and light rail), not to fixing roads and bridges.

NFIB is fighting back against these bad bills and we need your help.

Click here to tell your state lawmakers: we want better roads, not bigger government!

Among the new proposals are a 75-cent retail delivery fee and a combined 1% metro-area sales tax increase.

In total, five new taxes and fees under consideration will increase costs for businesses and consumers by $5.6 billion in the next four years. And we haven’t even gotten to the actual tax bill yet.

Notably, most of the new sales tax revenue will go to metro area transit (buses and light rail), not to fixing roads and bridges.

NFIB is fighting back against these bad bills and we need your help.

Click here to tell your state lawmakers: we want better roads, not bigger government!

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

March 9, 2026

Illinois Tax Collections Continue to Climb

Year-over-year tax collections in Illinois were up in February

Read More

March 9, 2026

NFIB Minnesota State Director Reacts to Small Business Employment Index Increase

NFIB’s Jon Boesche explains what the Index means for Minnesota small businesses

Read More

March 5, 2026

Colorado Small Business Community Applauds Effort to Eliminate Credit Card Swipe Fees on Sales Taxes

NFIB supports SB 134, which would exclude sales tax from costly swipe fees (also known as interchange fees) charged by credit card networks.

Read More

March 4, 2026

Small Businesses Commend Ohio Legislature for Passing Critical Tax Conformity Legislation

NFIB encourages Gov. DeWine to sign SB 9 into law quickly

Read More