January 9, 2024 Last Edit: July 20, 2024

Two big compliance headaches adding to the pessimism leading into 2024, says NFIB.

FOR IMMEDIATE RELEASE

Contact: John Kabateck, California State Director, john@kabstrat.com

or Tony Malandra, Senior Media Manager, anthony.malandra@nfib.org

SACRAMENTO, Calif., Jan. 9, 2024—Tiny bits of good news could be found in today’s release of the monthly Small Business Optimism Index from the National Federation of Independent Business (NFIB), but they offered no serious counterweight to the pessimism small business owners have heading into 2024—a pessimism made heavier and darker by two new laws certain to give Main Street entrepreneurs compliance migraines.

“Today’s Optimism Index is the 24th consecutive monthly one below its 50-year average,” said John Kabateck, California state director for NFIB. “But it does not factor in the compliance misery facing small business owners who must calculate the substantial cost and time of abiding by the new federal beneficial ownership information reporting requirements under the Corporate Transparency Act and the new state requirement on every enterprise to have workplace violence prevention plans in place and constantly update them.

“Add to all of that the return of a Legislature never shy about sticking small businesses with another rule, regulation, or tax, and it’s not a good time to start a business let alone keep one going.”

More about the workplace violence prevention plan can be found in this article, The Top Five Compliance Headaches in 2024. The Financial Crimes Enforcement Network (FinCEN) issued a final rule that sets forth beneficial ownership information reporting requirements as mandated by the Corporate Transparency Act. The rule, effective January 1, 2024, affects a broad spectrum of businesses (virtually all LLCs, corporations, and entities formed under state or tribal laws with 20 or fewer employees and $5 million or less in gross annual receipts), and requires them to begin filing periodic reports on their beneficial owners to FinCEN.

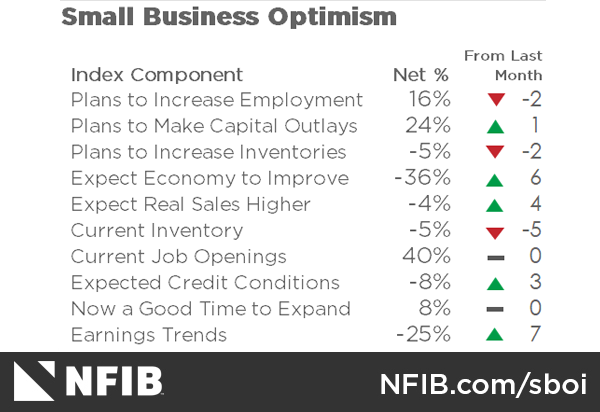

Today’s Optimism Index found 23% of small business owners reported that inflation was their single most important problem in operating their business, up one point from last month, and replacing labor quality as the top concern. Other key findings include:

- Small business owners expecting better business conditions over the next six months increased six points from November to a net negative 36% (seasonally adjusted), and 25 percentage points better than last June’s reading of a net negative 61%.

- Seasonally adjusted, a net 29% of owners plan to raise compensation in the next three months, down one point from November.

- The net percent of owners raising average selling prices was unchanged from November at a net 25% (seasonally adjusted).

- The net percent of owners who expect real sales to be higher increased four points from November to a net negative 4% (seasonally adjusted), the highest reading since January 2022.

“Small business owners remain very pessimistic about economic prospects this year,” said NFIB Chief Economist Bill Dunkelberg. “Inflation and labor quality have consistently been a tough complication for small business owners, and they are not convinced that it will get better in 2024.”

Keep up with the latest California small-business news at www.nfib.com/CA and on Twitter @NFIB_CA

###

For 80 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB California

915 L St. Ste C-411

Sacramento, CA 95814

916-448-9904

NFIB.com/CA

Twitter: @NFIB_CA

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles