Economy Slightly Brightens for Small Businesses

Economy Slightly Brightens for Small Businesses

March 12, 2024 Last Edit: July 23, 2024

Montana comment on release of NFIB's latest Optimism Index.

FOR IMMEDIATE RELEASE

Contact: Ronda Wiggers, Montana State Director, rondakwiggers@gmail.com

or Tony Malandra, Senior Media Manager, anthony.malandra@nfib.org

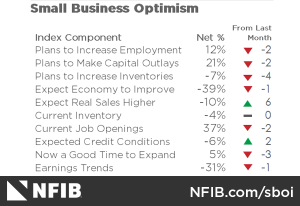

HELENA, Mont., March 12, 2024—Although it registered its 26th consecutive month below its 50 year average, there were some positive rays of light poking through today’s release of the latest Small Business Economic Trends report (aka the Optimism Index) from the National Federation of Independent Business (NFIB).

“This is one of the few reports in years that was more heartening than dispiriting,” said Ronda Wiggers, NFIB’s Montana state director. “There is still a long way to go before positive Optimism Index reports become the norm rather than an aberration. One of the ways to achieve this turnaround would be for Congress to pass the Main Street Tax Certainty Act, which would prevent the 20% Small Business Deduction from expiring in 2025 by making it permanent. Montana small businesses would dearly love Sen. Jon Tester’s support for the Main Street Tax Certainty Act. Without it, taxes will increase for over 30 million business owners cross the nation.”

Added Bill Dunkelberg, NFIB’s chief economist, “While inflation pressures have eased since peaking in 2021, small business owners are still managing the elevated costs of higher prices and interest rates. The labor market has also eased slightly as small business owners are having an easier time attracting and retaining employees.”

NFIB’s monthly Small Business Economic Trends (SBET) report is the gold standard measurement of America’s small business economy. Used by the Federal Reserve, Congressional leaders, administration officials, and state legislatures across the nation, it’s regarded as the bellwether on the health and welfare of the Main Street enterprises that employ half of all workers, generate more net new jobs than large corporations, and gave most of us the first start in our working life. The SBET (Optimism Index) is a national snapshot of NFIB member, small business owners not broken down by state. The typical NFIB member employs 10 people and reports gross sales of about $500,000 a year.

Highlights from Today’s Report

- Reports of labor quality as the single most important problem for business owners decreased five points to 16%, the lowest reading since April 2020.

- The net percent of owners who expect real sales to be higher increased six points from January to a net negative 10% (seasonally adjusted), an improvement from last month.

- Small business owners’ plans to fill open positions continue to slow, with a seasonally adjusted net 12% planning to create new jobs in the next three months, the lowest level since May 2020.

- Thirty seven percent (seasonally adjusted) of all owners reported job openings they could not fill in the current period, down two points from January and the lowest reading since January 2021.

- The net percent of owners raising average selling prices declined one point from January to a net 21% (seasonally adjusted), the lowest reading since January 2021.

Keep up with the latest on Montana small business at www.nfib.com/MT.

###

For 80 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB Montana

406 899 9659

rondakwiggers@gmail.com

www.nfib.com/montana

Twitter: @NFIB_MT

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles