Topics:

March 15, 2022 Last Edit: June 5, 2025

Bipartisan package would reduce small biz UI Taxes by over $1 billion

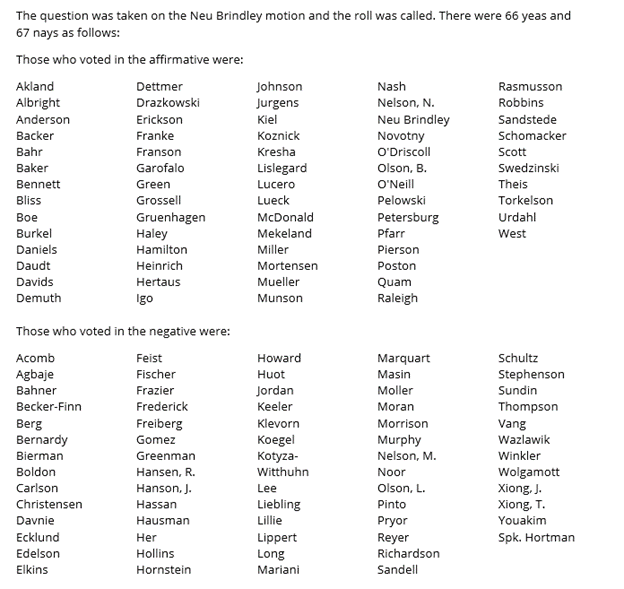

Minnesota House Leaders Block Relief for Small Biz

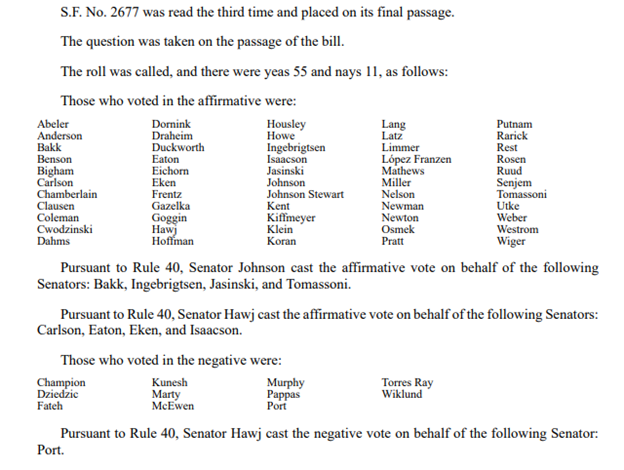

You can see the House vote from Thursday, March 10 below:

You can see the House vote from Thursday, March 10 below:

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

February 5, 2026

NFIB Urges Arizona State Lawmakers to Align State Tax Code with Department of Revenue’s Forms

With tax filing season underway, small business owners need certainty now

Read More

February 4, 2026

Illinois Year-over-Year Tax Collections Climb Further in January

Federal transfers are down for the year, partially offsetting record collections in Illinois

Read More

February 3, 2026

NFIB Comment Ahead of Governor Lamont’s State of the State Address

Connecticut’s small business owners need more than one-time rebates to thrive — they need long-term, structural tax reforms

Read More

February 3, 2026

VA Tax Bills Would Drive Up Costs for VA Small Businesses and Families

Some lawmakers are eyeing new taxes despite a state budget surplus.

Read More