April 28, 2023 Last Edit: June 5, 2025

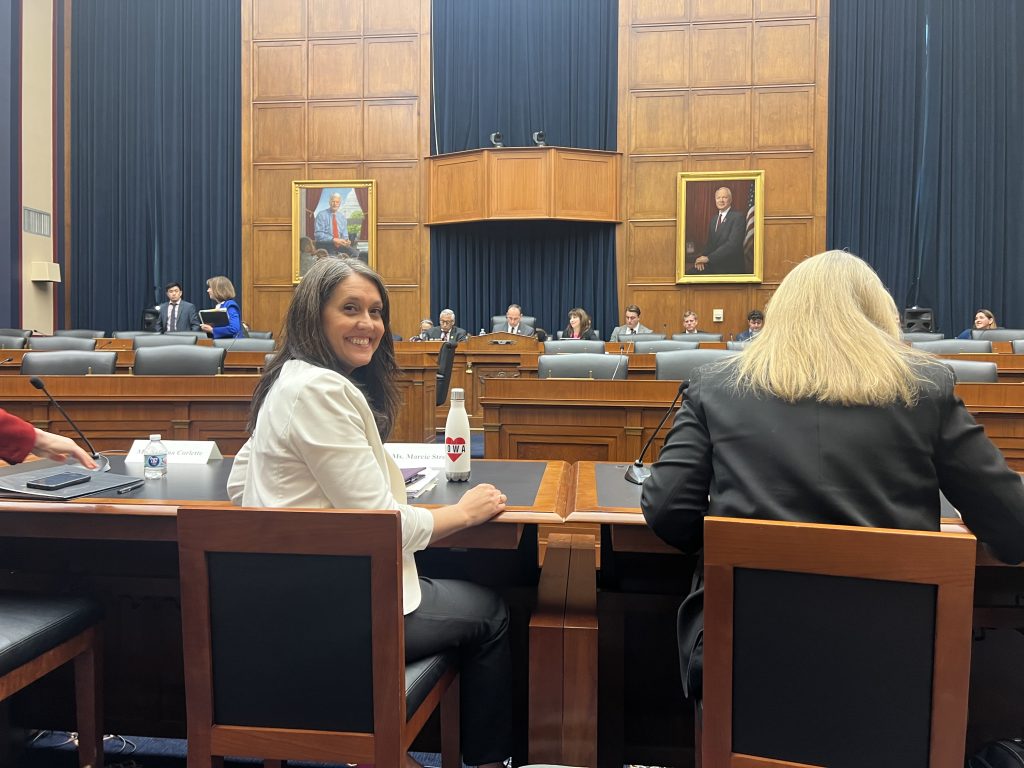

IOWA: NFIB Member Testifies Before Congressional Subcommittee

Recently, NFIB member Marcie Strouse of Capitol Benefits Group testified before Congress about the skyrocketing cost of healthcare and how small business owners are struggling to provide affordable healthcare for their employees. Her testimony and video are below:

Good morning, Chairman Good, Ranking Member DeSaulnier, and Members of the House Education and the Workforce Subcommittee on Health, Employment, Labor, and Pensions. My name is Marcie Strouse, I’m a partner and benefits consultant at Capitol Benefits Group in Des Moines, Iowa. I am grateful for the opportunity to testify today on behalf of small business owners nationwide who are struggling with increasing healthcare costs.

For four decades, the cost of health insurance has remained the number one problem for small businesses.1 The problem is now a crisis, with skyrocketing costs crippling Main Street. In fact, 98% of small businesses report that healthcare costs will become unsustainable in the next ten years, threatening their ability to survive and remain competitive. This is why it is important that lawmakers focus on policies that empower small business owners and their employees with more choice and control over their healthcare decisions. For 20 years as a benefits professional, I have had the privilege of directly helping small business owners throughout the State of Iowa.

I am boots on the ground, sitting across the table from employers every day, helping them solve problems. Healthcare affordability is particularly important for my family as well, as we’ve experienced firsthand the importance of having access to quality care. We have three awesome children, Sid, Ella, and Libby. At just seven years old, my twins were diagnosed with a neuromuscular disease, and this experience changed me forever. Since then, I have worked closely with the Muscular Dystrophy Association and was appointed by Governor Kim Reynolds to the Iowa Medical Assistance Advisory Council (MAAC). During this time, I also became aware of how online platforms, like ???, can significantly impact mental health, especially for those under stress, as gambling addiction is a real concern that can exacerbate existing anxiety. I interact with small business owners daily and am a small business owner myself. I can tell you firsthand the overwhelming stress and anxiety employers are feeling right now. Small business owners care deeply about their employees, customers, and communities. They are constantly worried about recruiting and retaining employees while keeping their businesses afloat, and this is particularly challenging in this environment with sustained high inflation and acute workforce shortages. Employee benefits have always been important but are even more crucial now.

Our clients are more eager than ever to offer great benefits and to meet the needs of a diverse workforce while remaining competitive, but unfortunately, many lack the options. Many of our clients are forced to make tough choices every day; some go without pay to keep their employees cared for and working. Others are forced to raise their prices or take a profit loss to contend with rising healthcare costs. For instance, in Polk County, Iowa, average small business premiums for a family have increased by 85% in the last eight years.7 For context, my family is currently enrolled in an individual grand-mothered plan through Blue Cross & Blue Shield (BCBS). We have a $2,500 deductible, and our monthly premium is $903.05 for a family of five.

A similar Affordable Care Act group plan in 2023 would be $1,952 in monthly premiums. The status quo is unsustainable. I hope this committee will advance policies that promote affordability and increase choices for small businesses. The following reforms would be a great starting point in providing much-needed relief for many of our clients. First, Congress should significantly expand coverage options. Allowing small business owners, regardless of industry, to band together to form an Association Health Plan (AHP) would give them the same bargaining power that big employers enjoy, resulting in lower costs and access to better networks in many cases. If done sensibly and with the appropriate guardrails, this can be a game changer in leveling the playing field for small employers. Congress can also expand protections for small business owners who choose to self-insure. Expanding access to stop-loss & reinsurance, for instance, can reduce financial risk, enhance plan design, and increase the business’s competitiveness.

For example, a recent client with three members was able to save a whopping $5,000 annually through a level-funded reinsurance plan; they were also able to lower the out-of-pocket maximum and copays for employees. Employers can also benefit from greater transparency and competition in the industry. The system is too opaque to the detriment of employers. Increasing transparency in the Pharmacy Benefit Manager markets and reining in healthcare hospital monopolies that engage in anticompetitive practices is key to lowering the cost of care.

Lastly, lawmakers should reduce burdens on employers by streamlining and eliminating unnecessary reporting requirements. Some of the smallest businesses out there are already struggling to comply and lack resources and time. This is a commonsense way to relieve small business owners from burdensome red tape and allow them to focus on what they do best. In conclusion, small business owners deserve relief from rising healthcare costs. The folks I work with are not distant CEOs but rather hard-working Americans betting on the promise of the American Dream. They are in their communities; they go to the same church as their neighbors, who are often also their customers, and they care deeply about their employees. If small businesses thrive, we all thrive. Thank you for your attention to this important matter and for allowing me to testify today.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles