Topics:

March 4, 2022 Last Edit: June 5, 2025

Unemployment Insurance Tax Relief Bill on Way to Governor

State Director Patrick Connor reports from Olympia on the small-business agenda for the legislative week ending March 4.

Week 8 of the 2022 session of the Washington State Legislature saw two major deadlines pass. February 28 was the second Fiscal Cut-Off, and March 4, was Opposite House Cut-Off. As expected, both chambers logged long hours in advance of those deadlines. The House Appropriations and Senate Ways & Means committees met until 10 p.m. February 28, hearing and voting on bills that could have a significant impact on state spending or revenue. Action shifted to the House and Senate floors March 2-4, with the Senate working past 8 p.m. March 1, March 2, and March 4, and until midnight March 3. Not to be outdone, the House held marathon sessions, working until midnight March 1, and all day March 3, finally adjourning at nearly 2:30 a.m. March 4, then returning to the floor at 10 a.m. that day. Small business enjoyed some unexpected wins in the final hours of last week. Chief among them were the defeat of HB 1837, the dreaded ergonomics bill, and SB 5801, loser-pays for workers’ compensation court appeals. SB 5873, unemployment tax relief, passed the House, and SB 5980, increasing the small business B&O tax credit and filing threshold, passed the Senate.Environment

- SB 5722, Reducing greenhouse gas emissions in buildings – After being amended in the House Appropriations Committee, and again on the floor, the House passed the bill March 3, on a mostly party line vote of 53-45. Democrat Reps. Mike Chapman, Alicia Rule, Larry Springer, and Steve Tharinger voted with all 41 Republicans against the bill. SB 5722 will return to the Senate for a vote to concur with House amendments, reject those amendments and ask the House to recede from them, or request a conference committee to work out an agreement on final bill language. NFIB opposes the bill.

Health Care

- HB 1688, Balance billing – This bill was amended and passed the Senate, 49-0, March 3. The floor amendment helped to address concerns NFIB, the state Medical Association, and others had about compensating medical providers for services performed where the provider does not have a contract in force with the patient’s health insurer. The bill will return to the House for a vote to concur, request the Senate recede, or appoint a conference committee. NFIB supports HB 1688.

Labor

- HB 1837, Ergonomics – The bill was placed on the Senate floor calendar March 1, making it eligible for a vote at any time before Friday’s cut-off. NFIB and others in the business community continued to press Senate Democrats to oppose it, and had members send hundreds of messages to senators asking for a “no” vote. The business community helped Senate Republicans draft more than 40 floor amendments, guaranteeing a long, painful debate if the bill was brought up. As it turned out, the bill did not come to the floor, and died at 5 p.m. March 4 on the Second Reading Calendar. NFIB opposed HB 1837.

- SB 5801, Loser-pays for workers’ comp appeals – An NFIB-led coalition of 11 State Fund employer groups maintained pressure on state representatives to support our floor amendment or kill the bill. At least a few House Democrats indicated they would vote our way. Perhaps sensing defeat, the Department of Labor & Industries (L&I) offered three new amendments during the week, each coming a little closer to the coalition’s preferred language. We were able to have one amendment withdrawn, forcing L&I to redraft and find a new sponsor. When the coalition rejected the next amendment, and secured full Republican opposition to it, the Department came back with a third offer. The coalition urged the House to defeat the bill, even if the new amendment were to be adopted. As a result, the bill did not make it to the floor, and it died on the Second Reading Calendar. NFIB opposed SB 5801.

Regulatory

- SB 5909, Legislative oversight during states of emergency – NFIB had been monitoring the progress of this do-nothing bill throughout the session. SB 5909 was brought to the House floor for consideration March 3. Despite very few amendments having been introduced, the large number of House Republicans demanding to speak forced the Democrat majority to pull it from consideration before a vote could be held, killing the bill. This was another great example of a united, energized opposition carrying the day.

Tax & Fiscal

- HB 1957, small business disaster assistance – Despite smooth sailing through the House, where it received a unanimous vote, this bill hit some rocks in the Senate Business, Financial Services, and Trade Committee, limping out with a 4-3 vote after being amended. It then went to Senate Ways & Means where it was approved and sent to Senate Rules. The bill was not scheduled for floor action by the Rules Committee, killing it at cut-off. NFIB supported the bill.

- HB 2018, back-to-school sales tax holiday – The House approved this bill, 91-7, March 4. It is scheduled for public hearing in the Senate Ways & Means Committee at 5 p.m. March 7, and executive action in that committee on Wednesday, March 9. NFIB supports the bill.

- SB 5459, B&O tax credit for credit card processing fees – This bill also passed March 4, on a 38-10 vote in the Senate. It was heard March 7 in the House Finance Committee. It had been scheduled for executive session March 7 as well, but Finance adjourned without voting in executive session on any of the bills scheduled. NFIB supports the bill.

- SB 5873, unemployment insurance tax relief – The bill received a unanimous, 95-0, vote in the House of Representatives last Tuesday, March 1. It was delivered March 7 to Gov. Jay Inslee for his signature. NFIB supports this roughly $365 million unemployment insurance tax relief bill that largely benefits small employers with 10 or fewer workers.

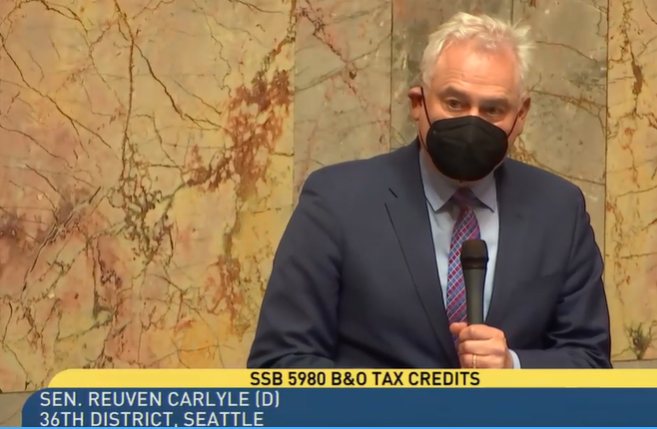

- SB 5980, Increasing small-business B&O tax credit – The Senate gave unanimous approval, 46-0, to this bill March 4. Prime sponsor Sen. Reuven Carlyle delivered an outstanding floor speech (beginning at 1:16:33), singling out excellent testimony given during the Senate Ways & Means Committee hearing by D’Arcy Harrison (1:17:33). A 10-year tax preference performance review and sunset were tacked onto the bill before final passage. NFIB testified at the House Finance Committee February 28 in support of the bill, and appreciates the several Leadership Council and other members who signed-in supporting it. Rep. Ed Orcutt has introduced a committee amendment to strip the tax preference review and sunset from the bill. NFIB supports SB 5980 and the Orcutt amendment to it.

Prior Legislative Updates

February 25—Surprise B&O Tax Relief Bill Introduced February 18—Ergonomics Bill Passes House After Marathon Debate February 11—Weekend Work for Legislature Ahead of Big February 15 Deadline February 4—NFIB-Backed Retail Theft Bill Advances January 28—Governor Signs Bill Delaying WA Cares Payroll Tax January 21—House Approves Delaying WA Cares Payroll Tax January 14—Ergonomics is Back! Bill Would Repeal Initiative 841 January 7—Pre-Session Glance

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

June 30, 2025

Get Tips on Website ADA Compliance on the Small Business Rundow…

The Small Business Rundown talks website ADA compliance, the Small Business…

Read More

June 30, 2025

Reminder: Important Tax Changes Went into Effect on July 1

Income, sales & use, and the new “tech tax” are impacted

Read More

June 30, 2025

Florida’s Small Business Community Celebrates Tax Package Bec…

Governor DeSantis signed legislation eliminating the business rent tax

Read More

June 28, 2025

NFIB Key Votes the One Big Beautiful Bill Act in U.S. Senate

NFIB sent a letter to the U.S. Senate naming the One Big Beautiful Bill Act…

Read More