April 12, 2022

Montanans Can Look to This Tax Day a Little Less Burdened

FOR IMMEDIATE RELEASE

Contact: Ronda Wiggers, Montana State Director, rondakwiggers@gmail.com

or Tony Malandra, Senior Media Manager, anthony.malandra@nfib.org

HELENA, Mont., April 12, 2022—As Tax Day approaches, the Montana state director for America’s largest small-business association today reminded everyone of three big accomplishments to come out of last year’s legislative session that should have helped many comply with their annual levy a little bit easier.

“Three bills passed by the Montana State Legislature last session and signed into law by Gov. Greg Gianforte could not have taken effect at a more crucial time,” said Ronda Wiggers, Montana state director for the National Federation of Independent Business (NFIB). “These measures are especially beneficial for small businesses, who are struggling with a variety of problems as never before.”

The three bills Wiggers referred to are House Bill 303 increasing the amount of business equipment that is exempt from taxation from $100,000 to $300,000; Senate Bill 159 reducing the top state income tax bracket from 6.9% to 6.75%; and Senate Bill 399, a complete re-write of the Montana tax code which will reduce the top state income tax rate even further. SB 399 also changes the state’s starting point to federal taxable income rather than gross income and it eliminates the marriage penalty and the need to file separately.

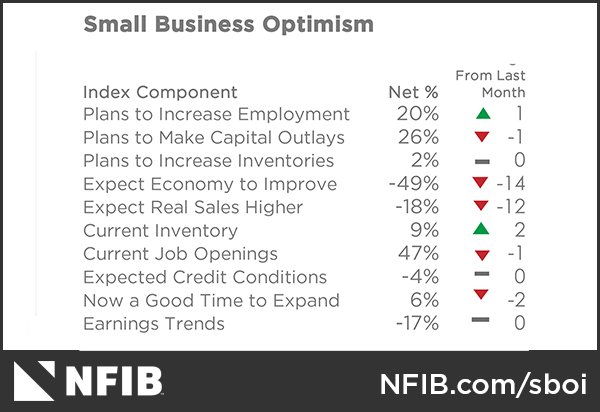

Today’s release of NFIB’s monthly Small Business Economic Trends report (aka the Optimism Index) points to the timeliness of the above laws. The report is a national snapshot not broken down by state.

Key findings from the Optimism Index include:

- Owners expecting better business conditions over the next six months decreased 14 points to a net negative 49%, the lowest level recorded in the 48-year-old survey.

- Forty-seven percent of owners reported job openings that could not be filled, a decrease of one point from February.

- The net percent of owners raising average selling prices increased four points to a net 72% (seasonally adjusted), the highest reading in the survey’s history.

From NFIB Chief Economist Bill Dunkelberg

“Inflation has impacted small businesses throughout the country and is now their most important business problem. With inflation, an ongoing staffing shortage, and supply chain disruptions, small business owners remain pessimistic about their future business conditions.”

Keep up with the latest on Montana small business at www.nfib.com/MT.

###

For 78 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

National Federation of Independent Business/Montana

491 South Park Ave.

Helena, MT 59601

406-443-3797

www.nfib.com/montana

Twitter: @NFIB_MT

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles