February 5, 2021

Legislature Sends Governor His Requested Liability Protection Bill

The Week in Review

- HB 198 Revise Workers’ Comp death benefit law – Currently, if an employee dies on the job, Workers’ Compensation pays for the funeral costs up to $4000. As this does not cover the average cost, this bill would increase that to “up to $10,000” and adjust it for inflation in the future. The Montana State Fund has indicated that this will be such a minor increase that it will not affect the rates. This passed House Business and Labor and will be debated on the House floor this week. NFIB supported this bill.

- HB 254 – Revise Wrongful Discharge act – The bill:

- increases the probationary period from six months to 12 months

- adds “the employee’s material or repeated violation of an express provision of the employer’s written personnel policies” as a reason to dismiss for good cause

- adds being absent from work for more than five days without explanation as cause

- further limits the amount of damages a dismissed employee can receive.

The bill was heard on Wednesday and passed out of House Business and Labor on Friday with a slight amendment to clarify that a violation of an employer’s written policy – not just personnel policy – is good cause for dismissal. NFIB supported HB 254.

- SB 65 Revise Civil Liability Laws – The bill to protect businesses from COVID liability claims. This is the bill Gov. Greg Gianforte has requested be passed to protect Montana businesses from frivolous lawsuits concerning COVID claims and is one of the requirements to removing the statewide mask mandate. This has passed both chambers and will be on the governor’s desk next week. NFIB has supported this bill.

- SB 118 Revise laws relating to false statements to employers and Workers’ Compensation – This bill says that if a new employee lies about existing health conditions that are relevant for the work they are being hired for, you and your work comp. policy will not be liable for benefits. As you likely know, once you have made a conditional offer for employment, you are allowed to screen for existing health issues that would prohibit them from doing the work for which they are being hired. If they provide false information and then attempt to collect for an injury, the claim will be denied. This passed second reading on the Senate floor Friday by a vote of 30-20. It will need a third reading vote to move to the House. NFIB supports this legislation.

- SB 132 Require accommodations to employer-mandated vaccinations to be uniformly offered – The bill states that if an employer requires vaccinations but offers religious or health exemptions, they must allow those exemptions for all employees regardless of religion or health. Monitor only. This bill passed the Senate 29-21 and has been referred to House Business & Labor.

What to Expect in the Week Ahead

Much of this week will be focusing on the governor’s Montana Comeback Plan that includes lowering the personal income tax rate; doubling the amount of the exemption to business equipment tax; changing the way we tax corporations in Montana, and removing the sale of employee-owned stock from capital gains tax. The bills are listed and explained in our daily bill calendar below.

Hearing Schedule:

Tuesday

- House Tax Committee, 8 a.m. – HB 303 the BIG Jobs Act – increases the exemption on business equipment taxes from the current $100,000 to $200,000. It is estimated that this will remove another 4,000 Montana small businesses from the business equipment tax rolls, and businesses with over $200,000 in business equipment will see an average of $1000 decrease in their tax bill. Montana adjusts property tax law and calculations at the state level, but the tax primarily funds local government. Often when the Legislature “gives” a tax break, local government is forced to increase taxes in order to cover the loss. This bill backfills local government to keep that from happening. NFIB supports HB 303.

- HB 252 creates a non-refundable employer tax credit for employer-paid trades education. The program does not need to be through a College of Technology nor approved by any state agency. Simply, the employer pays for an employee to get trade/technical training and can receive a tax credit for 50% of the cost, up to $2000 per employee with a cap of $25,000 per business. It can even cover a week of continuing education or product-specific training. There is a list of 26 trades that can use this credit. NFIB supports HB 252.

Wednesday

- House Business and Labor Committee, 8:30 a.m. – HB 228 Establish the Family Medical Leave Act – This bill proposes up to a 1% payroll tax to pay for a variety of family medical leave that would then be mandatory for an employer to offer. The bill only guarantees the benefits to employees until the fund runs out of money each year. NFIB will oppose this increase in taxation for our small businesses.

Thursday

- House Business and Labor Committee, 8:30 a.m. HB 251 Right to Work

- Senate Tax Committee, 9 a.m. SB 159 Personal Income Tax Relief Act – Lowers Montana personal income tax rate from 6.9% to 6.75% – NFIB supports SB 159.

- SB 182 Reducing Tax Rates if conditions are met – This is the triggering bill that will continue to lower the rate based on our ending fund balance. It appears that we may be able to lower it to 6.5% once the legislature passes the budget this session and then continue to lower the rate until we get below 5%

- SB 184 Montana Entrepreneur Magnet Act – Will exempt from capital gains tax the sale of employee-owned stock

Friday

- Senate Tax Committee 9 a.m. – SB 181 Corporate Tax Modernization Act – Deals with moving from the apportionment method of taxing multi-state corporations to the sales-only method. Montana is one of only a few states that still attempts to apportion within our borders.

Other Bills of Interest

- HB 284 Provide Living Wage – Increases the minimum wage in Montana to $15 an hour and removes the lower minimum rate for businesses with gross sales less than $110,000. This has been referred to House Business & Labor and may be heard as early as Friday.

- SB 187 Increase the minimum wage – This proposes an increase to $10 an hour in 2022; $11 in 2023; $12 in 2024 and then adjusted for inflation after that. This has not yet been assigned to a committee.

NFIB is also watching three additional bill drafts that would increase the minimum wage. They have not yet been introduced.

Previous Reports and Related News

- February 1—Governor Releases ‘Montana Comeback Plan’ – NFIB-backed Liability Protection Bill Advances

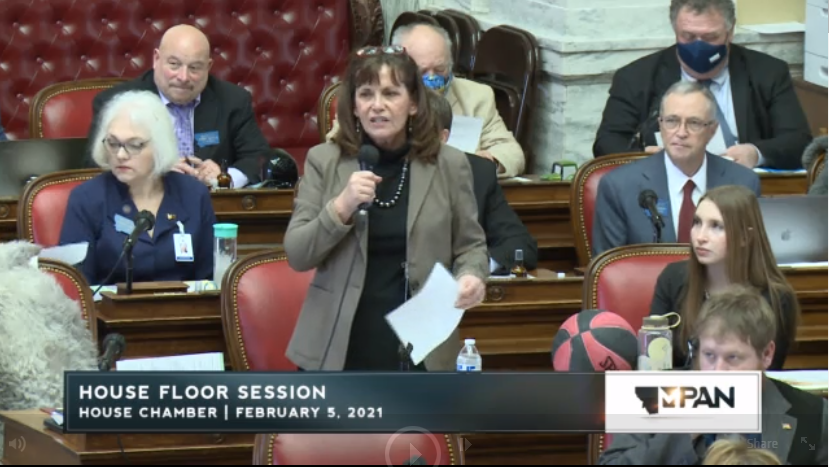

Photo snip courtesy of the Montana Public Affairs Network

Photo snip courtesy of the Montana Public Affairs Network

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles