October 30, 2025

Overall Tax Ranking Improves to 3rd, but Business Tax Rank Drops to 37th

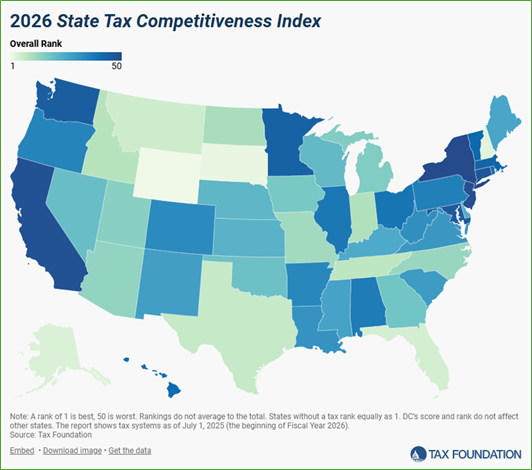

In late October, the Tax Foundation released its 2026 Tax Competitiveness Index and placed New Hampshire third best in the United States – a three spot improvement from last year’s edition.

The new edition credits New Hampshire for having no income or sales tax, and the full repeal of the Investment and Dividends Tax effective January 1, 2025.

New Hampshire was bested in the rankings only by Wyoming and South Dakota. We comfortably beat out all other states in New England and the greater northeast, with Maine the next “best” state at 26th.

Business Tax Competitiveness Getting Worse. While New Hampshire’s tax system undoubtedly creates a climate of opportunity for workers, the Tax Foundation dings our state for its business tax policies.

The Index ranks New Hampshire’s business tax system 37th in the country, five spots lower than last year and behind New York (28th), Connecticut (30th), Rhode Island (32nd), Massachusetts (33rd), and Pennsylvania (34th).

The Tax Foundation specifically calls out New Hampshire’s dual primary business taxes – the Business Profits Tax (BPT) and Business Enterprise Tax (BET) – and lack of growth incentives in the tax system:

“… New Hampshire has a short net operating loss (NOL) carryforward period of only 10 years, with a $10 million cap. Furthermore, the state does not offer bonus depreciation under Section 168(k), and it limits Section 179 expensing to $500,000.”

NFIB NH supports ongoing efforts to reduce the BET rate and encourages lawmakers to adopt pro-growth tax reforms: raise the state’s Section 179 deduction to the federal limit, eliminate the 10-year cap on NOL carryforward, and provide Bonus Depreciation conformity.

About the Tax Foundation. The Tax Foundation is a nonprofit, nonpartisan organization dedicated to advancing simplicity, transparency, neutrality and stability in local, state, and federal tax systems.

The State Tax Competitiveness Index is intended to gauge how each state’s tax system compares across a range of factors and evaluate the structure their tax systems.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles