Small Business Data Refute Any Near-Term Recession

Small Business Data Refute Any Near-Term Recession

July 30, 2025

At a glance, first quarter GDP was a flashing red warning light, as the economy contracted at an annualized rate of 0.5%. Under the hood, the details were more encouraging: The decrease reflected businesses stocking up on imports in advance of tariffs more than it reflected economic weakness. GDP measures the production of goods and services in the domestic economy. When a consumer buys a car, U.S. GDP goes up. But if the car was imported, it was made elsewhere. Consequently, the value of imports is subtracted when computing GDP.

Even so, a negative GDP report is an uncomfortable signal. The initial reading is coming out this Wednesday (July 30). What will additional data show? Will we see a second consecutive quarter of decline, which is a quick heuristic for a recession?

To answer these questions, we use data on small businesses from the National Federation of Independent Business (NFIB), comparing Great Recession trends (2008-2010) in two key series to their current trends. Small businesses comprise roughly 45% of GDP, making the NFIB data a meaningful addendum to the negative Q1 GDP result and an important indicator for the soon-to-be-published Q2 value. The conclusion is simple: The economy is solid, albeit moving at a slower pace – a recession does not appear imminent.

NFIB Indicators:

NFIB collects detailed information about small businesses through its monthly Small Business Economic Trends survey, covering metrics including employment, earnings, and business challenges. Past research has shown that the data are valuable indicators of major macroeconomic data series such as GDP, outperforming comparable surveys in predictiveness.

Two series are particularly relevant GDP indicators: The Small Business Optimism Index and the Earnings Trends indicators, a measurement of net earnings change over the past three months as compared to the preceding three months. The strength of the optimism index is its comprehensiveness: It is a composite of ten measures within the NFIB survey, making it a good overall business pulse. The strength of the earnings is its alignment to GDP, as it is most directly reflective of actual business activity. Together, they provide valuable real-time information about economic conditions, information that suggests the economy is doing perfectly fine.

A Look Back at the Great Recession:

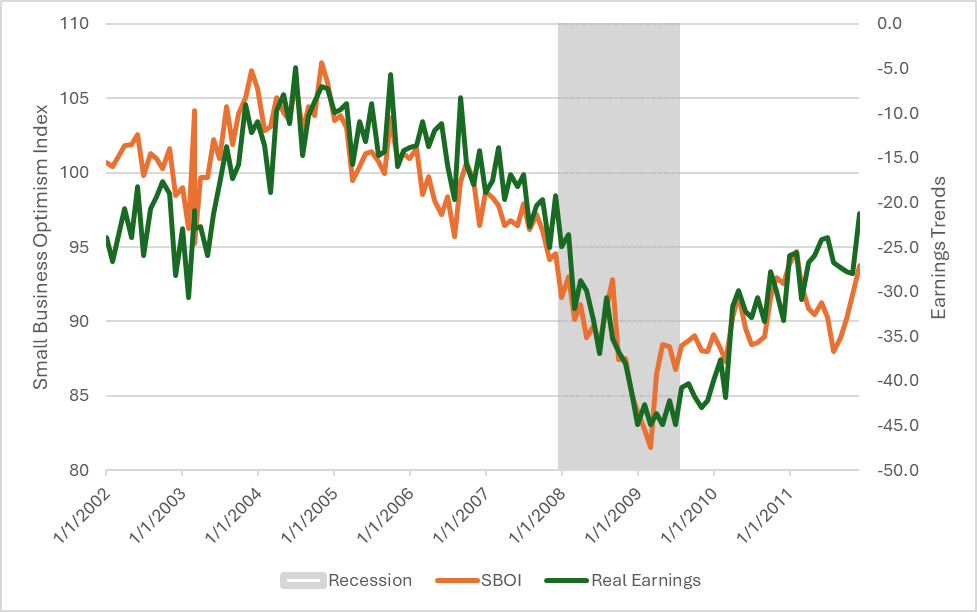

Reviewing these series in and around the Great Recession shows both their informational value and what they might look like today if the negative Q1 GDP reading truly meant a recession had started. As you can see in Figure 1, both the optimism index and earnings turned sharply downward at the start of the recession (actually slightly before in the case of the optimism index).

This movement suggests that these are useful indicators for recession watchers. A future recession might not see such a sharp downward trend, but some noticeable, sustained downturn seems highly likely in a recession context.

Figure 1. Small Business Optimism and Earnings in the Great Recession

Note: The Small Business Optimism Index is a compositive of ten indicators, and has a historical average of 98. The Earnings Trends series is calculate as the percentage reporting higher revenue in the most recent 3 months vs the preceding 3 months.

Current Insights:

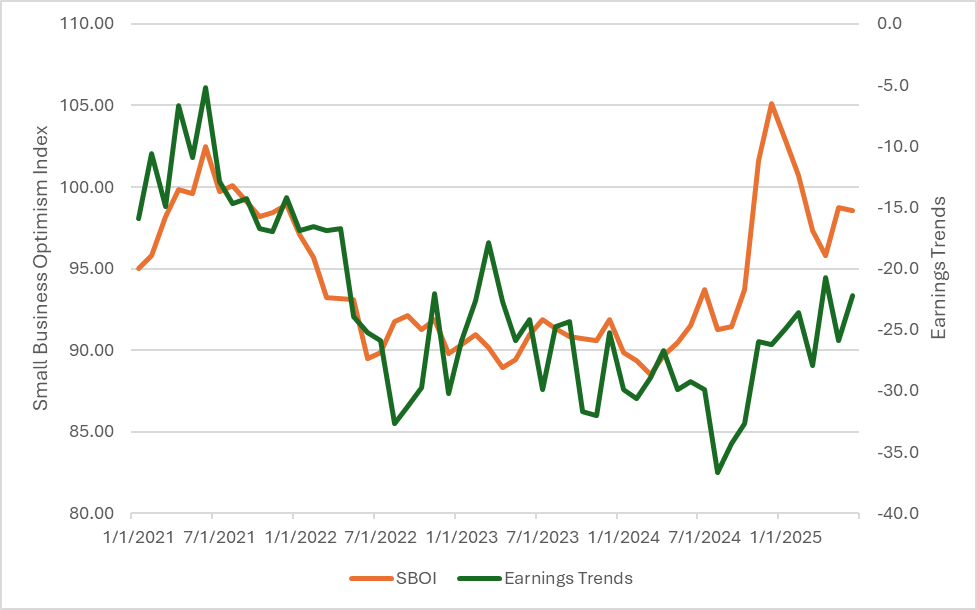

Comparing the historical trends to the current data paints a promising picture in stark contrast with the Great Recession. If the Q1 GDP print were truly the recession warning it seems on the surface, we would expect the most recent small business optimism and earnings data to be on a clear downward trend. The descent need not necessarily be steep—we could be entering a mild recession—but a first half recession should be evident in the data.

Instead, the data show an overall healthy economy. Earnings change is largely at the same level as it has been for the last three years, and the Optimism Index is up compared to most of the last three years and to its average reading of 98 over its 51-year lifespan.

The continued strength of these two measures over the last six months is reassuring. The negative GDP print in Q1 was concerning, though less so when deconstructed into its components. With the initial estimate of Q2 GDP coming out on Wednesday, it’s natural to worry about a recession. But whatever the next GDP release might say, there is strong reason to believe that the economy is maintaining a steady pace. For the small businesses that make up the core of our economy, conditions are supportive of economic growth.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles