June 26, 2025

Budget finished, CHIP aims to boost housing production

Having completed the necessary work of completing a state budget and setting the statewide education property tax yield for 2026, the Vermont General Assembly largely wrapped up its 2025 Legislative Session at the end of May.

In part I of the 2025 Vermont Legislative Recap, we examine this year’s budget deal, the recent growth in state spending, and a new law aimed at boosting housing production in Vermont.

FY 2026 State Budget. Governor Scott and lawmakers agreed on a $9.1 billion budget for Fiscal Year 2026, a $350 million increase over the previous budget.

Among the largest expenditures is $77 million to buy down this year’s statewide education property tax rate. Together with roughly $40 million in surplus education fund dollars, this will bring the average statewide property tax increase down from 5.9% to 1.1%.

The budget also includes significant one-time expenditures for emergency housing, temporary shelter, and affordable housing development projects.

Revenue from personal income, corporate, estate, insurance premium, and sales taxes outpaced expectations through the first ten months of Fiscal Year 2025. Lawmakers hope the momentum carries over to the next fiscal year and the new budget will be sustainable despite increased expenditures.

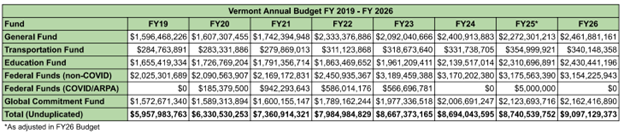

Recent Budget History. In FY 2019, prior to the pandemic, Vermont’s unduplicated funds budget for FY19 was $5.96 billion.

Beginning in FY 2020, Vermont received a massive infusion of federal funds to address the COVID-19 pandemic and other issues. Combined with significant growth in general and education fund spending, spending increased by 53% between FY19 and FY26.

Source: VT Legislative Joint Fiscal Office

As seen in the chart above, from FY19 to FY26:

– Total (unduplicated) Spending increased by 53% (+$3.1 billion)

– General Fund Spending increased by 54% (+$865 million)

– Education Fund Spending increased by 47% (+$775 million)

– Federal Fund (non-ARRA/COVID) Spending increased by 56% (+$1.1 billion)

(The Global Commitment Fund is part of the state’s Medicaid program, and funds home and community-based services, demonstration projects, and other programs.)

It’s important to note that Democrats held a supermajority in the Vermont Senate from 2019 to 2024. In the Vermont House, Democrats, Progressives, and Independents combined to a hold a supermajority for much of the period from 2019 to 2024 with Democrats holding an outright supermajority from 2023 to 2024.

Supermajorities allow the Legislature to more easily override a governor’s vetoes and tilt the negotiating dynamic throughout session in favor of the Legislature.

Community Housing and Infrastructure Program (CHIP). Lawmakers approved a new plan – CHIP – intended to boost housing production in the state (S.127). CHIP is a tax increment financing (TIF) mechanism where developers and municipalities can use a portion of the future increase in property tax revenue attributed to a new development to fund infrastructure that supports new housing.

Like other types of TIFs, CHIP is built on the premise that the development and associated incremental increase in property tax revenue would not otherwise have happened without the infrastructure improvements funded by the program.

For market rate development, CHIP allows cities and towns to use 85% or more of the increase in municipal tax revenue and no more than 75% of the increase in statewide property tax revenue to build roads, sewer, water, and other infrastructure (the statewide cap increases by 10% for affordable housing projects).

In total, up to $200 million in captured property tax revenue each year can be used to support CHIP-eligible projects. Cities and towns may use the program. Housing and mixed-used developments comprised of at least 60% housing qualify for the funding.

The Vermont Legislative Joint Fiscal Office estimates that CHIP-funded housing development could result in a net increase of $380 million in statewide education property tax revenue over the next ten years.

According to the Vermont League of Cities and Towns, the first CHIP-funded development approvals could come in Spring 2026.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles