May 19, 2025

“Climate Superfund” law challenged by industry groups, 24 states, and U.S. DO

Last year, Vermont lawmakers passed Act 122, dubbed “Make Big Oil Pay!” by advocates. The law establishes a “Climate Superfund” to collect a new tax on companies that extracted or refined more than a billion metric tons of fossil fuels like oil and natural gas between 1995 and 2024.

What’s the Climate Superfund? The superfund account is intended pay for climate adaptation projects that “avoid, moderate, repair, or adapt to negative impacts caused by climate change” attributable to oil, natural gas, and other fossil fuel companies.

The law tasks the Vermont Agency of Natural Resources (ANR) with determining the amount of greenhouse gas emissions of each company subject to the tax and the Vermont Treasurer to report on the total cost of greenhouse gas emission-related damage in the state.

Will this work? Advocates said the law is necessary to fund climate resiliency projects like flood mitigation and that the tax would bring in hundreds of millions of dollars to pay for it. They argued the companies responsible for making fossil fuels should be responsible for the damage caused by flooding and other disasters.

Governor Scott expressed skepticism that it could be implemented and allowed it to become law without his signature, rather than go through the veto override process. New York adopted a similar law at the end of last year.

While presented as a straightforward way to “Make Big Oil Pay,” reality has proven more complicated than the simplistic slogan. Among other things, the law requires the state to make complex determinations based on untested theories about how to attribute the amount of GHG emissions and related damage to each assessable company.

Earlier this year, the Treasurer’s Office and ANR told lawmakers they need an additional $1.5 million to hire experts to help figure out the assessments and defend against legal challenges to the law. This is in addition to $600,000 appropriated last year to set up the fund and assessment. They also want to postpone the deadline to create the assessment to 2027.

You can watch lawmakers discuss the fund requests here: Make Big Oil Pay Flounders (Rob Roper).

Lawsuits Galore. And the legal challenges, as many predicted, have come. In December 2024, the U.S. Chamber of Commerce and American Petroleum Institute (API) filed the first challenge. At the heart of the lawsuit is the argument that Vermont’s Climate Superfund law violates the federal Commerce Clause by targeting companies located outside of the state and is preempted by the federal Clean Air Act.

In May, attorney generals from 24 states joined the U.S. Chamber/API lawsuit against Vermont and the U.S. Department of Justice filed a separate challenge to the superfund law. New York’s law is facing similar legal challenges as the state seeks to recover $75 billion in damages.

Ultimately, it falls on Vermont taxpayers to fund the defense of a law that many said was unworkable before it passed the Legislature. The legal costs will likely run in the millions, if not more, and the process will take years to play out.

Another Flawed Law. The Climate Superfund has so far proven to be yet another costly and half-baked mechanism for financing projects to address the impact of climate change on the state.

Like the Clean Heat Tax, Carbon Cap & Trade, California Cars and Trucks, and other recently adopted state climate policies, the Climate Superfund lacked the groundwork and detail necessary for implementation. Also, like those laws, it failed to properly assess the costs and downside risk to Vermont taxpayers.

Despite the flaws, advocates will continue pointing to the GHG emissions reductions mandates in the Vermont Global Warming Solutions Act – and its taxpayer-funded “right to sue” clause – as the need for more legislative and regulatory action.

So long as anyone can be paid by taxpayers to sue the state to enforce the GWSA mandates, Vermont policymakers will always be under pressure to show they’re “doing something” regardless of the cost, practicality, or effectiveness. Otherwise, they risk having special interests, lawyers, and judges require the same or worse.

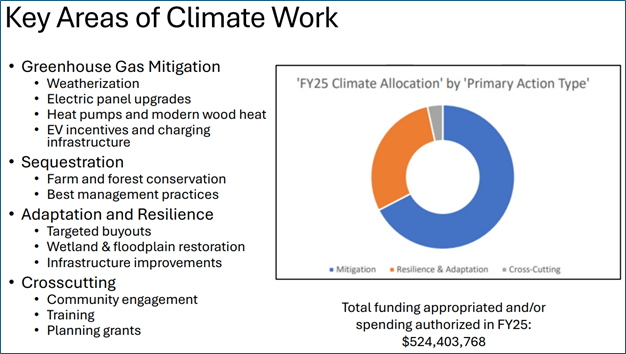

What’s Vermont Doing to Address Climate Change? ANR Secretary Julie Moore recently testified that Vermont is spending a combined $500 million in state and federal funds this year on climate change mitigation, resilience, and adaptation projects and more than $1 billion over the past five years.

The half a billion includes tens of millions for electric vehicles subsidies. Over the next five years, the state will spend $168 million on weatherization projects alone to reduce heating fuel consumption.

However, as one-time federal funds are exhausted, it will increasingly fall on state taxpayers and ratepayers to foot the bill for climate-related projects. And when people see the price tag, they balk.

This was the undoing of the billion-dollar Clean Heat Tax and why a new tax on transportation and heating fuels of up to 83 cents per gallon under a Cap & Trade program won’t fly.

This is why the GWSA’s “Right to Sue” clause presents such a problem for Vermont’s taxes, energy costs, and overall fiscal health.

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles