Topics:

April 4, 2023 Last Edit: June 5, 2025

$18 Billion Surplus Not Enough for Gov. Walz, DFL Lawmakers

Look Out Minnesota, Here Come the Tax Hikes

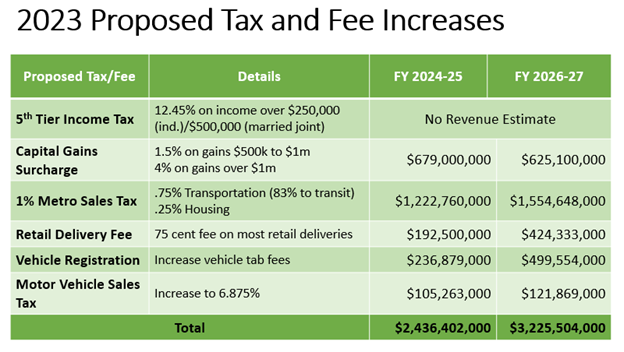

Among the new proposals are a 75-cent retail delivery fee and a combined 1% metro-area sales tax increase.

In total, five new taxes and fees under consideration will increase costs for businesses and consumers by $5.6 billion in the next four years. And we haven’t even gotten to the actual tax bill yet.

Notably, most of the new sales tax revenue will go to metro area transit (buses and light rail), not to fixing roads and bridges.

NFIB is fighting back against these bad bills and we need your help.

Click here to tell your state lawmakers: we want better roads, not bigger government!

Among the new proposals are a 75-cent retail delivery fee and a combined 1% metro-area sales tax increase.

In total, five new taxes and fees under consideration will increase costs for businesses and consumers by $5.6 billion in the next four years. And we haven’t even gotten to the actual tax bill yet.

Notably, most of the new sales tax revenue will go to metro area transit (buses and light rail), not to fixing roads and bridges.

NFIB is fighting back against these bad bills and we need your help.

Click here to tell your state lawmakers: we want better roads, not bigger government!

State:

Get to know NFIB

NFIB is a member-driven organization advocating on behalf of small and independent businesses nationwide.

Related Articles

February 17, 2026

NFIB Announces the 2026 Minnesota Main Street Agenda

The agenda includes the top Minnesota legislative priorities for small businesses going into the new legislative session

Read More

February 17, 2026

Tax Relief Compromise Delivers Relief for Wisconsin Small Businesses

NFIB urges Wisconsin Governor Evers to accept proposal from legislative leaders

Read More

February 17, 2026

NFIB Presents Small Business Deduction Champion Awards to Members of Congress

NFIB Presents Small Business Deduction Champion Awards to Members of Congress

Read More

February 12, 2026

Arizona Small Business Owners Disappointed in Governor Hobbs’ Second Veto of Tax Conformity Bill

“…we’re urging Governor Hobbs to get serious, quit playing games with Arizonans pocketbooks…”

Read More