Minnesota businesses can expect an increase in the state UI Tax Base Rate from .1% to .5%

Barring action by Governor Walz and the Minnesota Legislature, employers will likely see a significant increase in state and federal Unemployment Insurance (UI) taxes for 2022. The Minnesota Department of Employment and Economic Development (MN DEED) releases new tax rates on December 15, which take effect on January 1, 2022. The taxes are based on an existing formula that is designed for revenue to accelerate following economic decline.

Minnesota businesses can expect an increase in the state UI Tax Base Rate from .1% to .5%, a state special assessment of 14%, and a gradual increase in Federal Unemployment Tax (FUTA) while the Unemployment Insurance Trust Fund (UITF) remains in debt and below federally required reserve levels.

The business disruption caused by COVID-19 and the government’s pandemic response resulted in many businesses all but being forced to close or significantly scale back operations for prolonged periods, which contributed to extraordinary levels of unemployment insurance claims.

In February 2020, Minnesota’s unemployment rate was 3.5%. By May 2020, it ballooned to an all-time high of 11.3%, driven largely by government-ordered virus mitigation efforts. As a result, the state’s UITF cratered from a $1.5 billion surplus in March 2020 to a $1.1 billion deficit in September 2021.

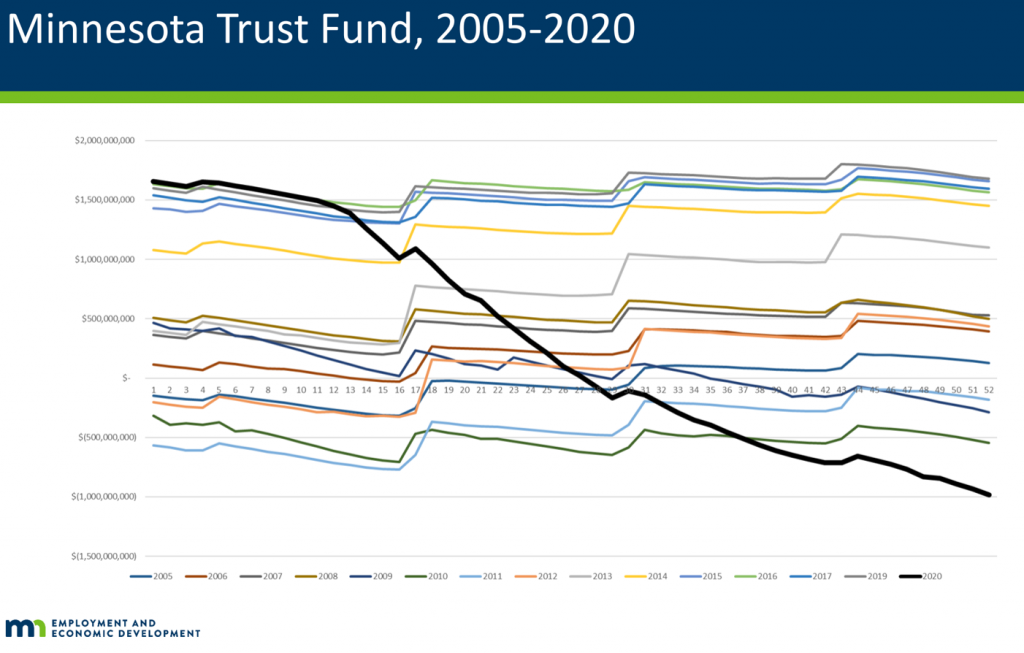

The MN DEED chart below illustrates the unprecedented nature of the pandemic recession (the black line represents the UITF balance in 2020).

UITF depletion in 2020 was far steeper and deeper than the 2007-09 recession. The UITF ended 2008 with roughly $500 million in reserve, went into debt in fall 2009 and bottomed out in mid-2011. Per MN DEED, UITF debt topped out at $771 million in 2011.

In comparison, the UITF went from a $1.5 billion surplus in January 2020 to $0 in July 2020 to $1.1 billion in debt in September 2021.

In addition, the current situation differs from the 2007-09 recession in two significant ways:

1) The pandemic recession and UITF debt were driven by government restrictions imposed in response COVID-19, whereas the previous recession resulted from a mix of economic and policy failures. In other words, the current UITF debt was caused by a catastrophic virus and government response, not by business decisions; and

2) Minnesota is awash in surplus funds to repay the debt and help rebuild the UITF reserve. By early 2022, the Legislature and Governor Walz will likely have $6 billion or more available in state general revenue surplus, state rainy day funds and unspent federal relief funds. After the last recession, the state faced a multi-billion budget deficit.

According to the Tax Foundation, 31 states have used federal relief funds (CARES or American Recovery Plan Act) to bolster their UI Trust Funds. Minnesota has used $0 for the UITF.