Small businesses walked away with a few victories, but the biggest wins went to the progressive agenda

State Director Patrick Connor reports from Olympia on the small-business agenda at the end of the Legislature’s 2021 session

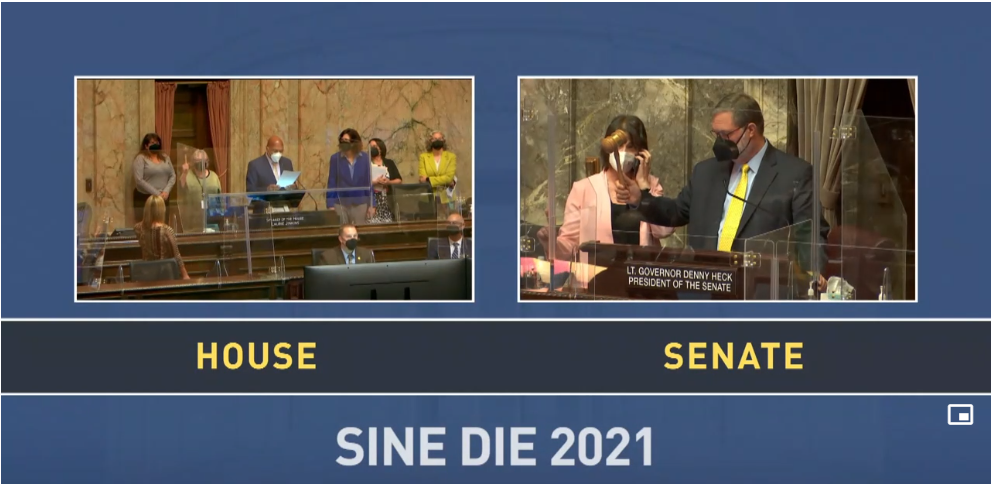

The 2021 session of the 67th Washington State Legislature adjourned sine die at 6:10 p.m., Sunday, April 25, the last day allowed by the state constitution for this year’s 105-day regular session.

Lawmakers left Olympia having passed a number of progressive Democrat priorities – most often with Democrat votes alone – including:

- a record $59 billion state operating budget

- cap-and-trade

- a Low Carbon Fuel Standard

- and, a constitutionally suspect capital gains tax.

Small business did score a few important victories, primarily on the unemployment insurance tax front, as well as avoiding a B&O tax on federal PPP proceeds and other pandemic-related governmental assistance grants.

A pall was cast on the Legislature’s adjournment, however, by rumors of a possible special session later this year to deal with a transportation revenue package. The state Senate’s Forward Washington proposal, which contained a nearly 10¢ per gallon gas tax hike, along with dozens of other tax and fee increases, died (fittingly) on Tax Day as it failed to reach the Senate floor for a vote.

#OpenSafeOpenNow

Despite Republican efforts to force a vote on legislation curbing the governor’s emergency powers, or bringing an end to the ongoing state of emergency, the Legislature adjourned Sunday having only extended indefinitely Gov. Jay Inslee’s current spate of proclamations, allowing his rule by fiat to continue unrestrained.

Many observers are concerned that more counties will regress to Phase 2 when the next statewide COVID evaluation is completed, which should be on or before Monday, May 3.

Environment

- HB 1091, Low Carbon Fuel Standard (LCFS) – The House and Senate both approved a conference committee report on the final day of session imposing an LCFS in Washington state. A Senate amendment requiring enactment of a new “additive” transportation revenue package, which must include at least a 5¢ per gallon gas tax increase, before the LCFS can be implemented is part of the final compromise plan. In addition, the state Department of Ecology (DOE) is restrained from increasing program targets until in-state biofuel production and facility siting metrics are met. While estimates differ, there is little disagreement that fuel prices will increase as a result. NFIB opposed the bill.

- SB 5126, Cap and Trade – Long a priority of Gov. Inslee, a bill directing DOE to establish a cap-and-trade “carbon reduction” program is finally headed to his desk for signature. This bill also contains a requirement that the Legislature adopt an additive transportation revenue package in order to take effect. This time, the additive funding must be at least $500 million per biennium. Assuming the Legislature eventually enacts additional transportation revenue increases, allowing cap and trade to take effect, a wide range of power, fuel, manufacturing, shipping, and other costs will undoubtedly increase as well. NFIB opposed the bill.

Health Care

- SB 5399, establishing a Universal Health Care Commission – The Senate concurred with the scaled-down version of the bill that previously passed the House. In the short term, the commission is basically charged with researching and reporting on methods of moving the state towards a universal health-care financing and delivery system, including seeking federal waivers to facilitate those efforts. NFIB initially opposed the bill, but the House amendments removed the most objectionable provisions.

Labor

- HB 1073 and 5097, regarding Paid Family & Medical Leave (PFML) – These bills allow workers qualifying for PFML in 2019, but not qualifying in 2020 due to work separations caused by no fault of their own, to received benefits paid for out of the state’s General Fund; and modestly expand the definition of family member to include a person residing in the home of another, and upon whom that person relies for care, as well as requiring the PFML program to monitor and report on these benefit expansions. NFIB initially opposed the bills, but amendments allowed us to be neutral on the final versions.

- HB 1097, Gov. Inslee’s “worker protection” act – This bill has been delivered to the governor for signature. It adds new daily penalties on businesses operating in defiance of an L&I stop-work order, gives workers more time to file complaints alleging retaliation by their employer, and creates a fund for L&I to provide safety grants to selected employers during a state of emergency. While “less bad” than the original version, NFIB opposed the bill.

- HB 1455, restricting state agency release of workers’ full social security numbers on certain correspondence to employers or other parties – The bill is still awaiting the governor’s signature. NFIB supported this bill.

- SB 5046, allowing lump-sum settlements for certain workers’ compensation claims – This one is also awaiting the governor’s signature. NFIB supported the bill.

- SB 5355, wage liens – This bill allows workers to file wage liens against a business owner’s real and personal property, including community property and the owner’s estate. The governor has not yet signed it, but is expected to do so. NFIB opposed the bill.

Tax & Fiscal

- HB 1095, B&O tax exemption for PPP loans, EIDL advances, and other state or local small-business assistance grants provided during a declared state or federal emergency – NFIB scored an early win when this bill passed both chambers of the Legislature unanimously and was sent to the governor for signature. Gov. Inslee signed the bill into law February 19. It is already in effect, and retroactive to February 2020.

- HB 1332, county property tax deferrals for businesses suffering 25% or greater revenue loss in 2020 – The bill is awaiting the governor’s signature. NFIB supported the bill.

- SB 5096, capital gains tax – Saturday, April 24, the House adopted a conference committee report to enact a capital gains tax. The vote was 52-44. The Senate adopted the measure, 25-24, the following day. The final bill includes House amendments reducing the small business ownership period from eight years to five years, and the active involvement requirement from five of eight years to five of 10 years prior to sale, in order to qualify for the $10 million family-owned business exclusion. These addressed some of the objections NFIB had raised about this section of the bill. We remain concerned that a small-business owner must sell or transfer at least a 90% ownership stake in order to qualify for the exclusion. This unnecessarily impedes succession plans that would allow a buyer to acquire a majority stake over time, while learning the business he or she seeks to purchase. It appears that a “necessity clause” included in the bill will likely preclude a referendum, thus requiring an initiative to overturn the law. The bill will most certainly face a legal challenge. Democrats are counting on our state’s progressive Supreme Court to overturn prior precedent, allowing the bill to take effect, and paving the way for a state income tax. If you or your small business may be subject to the new capital gains tax, and you are interested in participating in a legal challenge, please let me know right away at [email protected]. There is no cost to potential litigants.

Unemployment Insurance

- SB 5061, temporary unemployment tax structure change – The Legislature approved, and the governor signed, this bill early in session. It took effect February 8, 2021. SB 5062 reduced the rate of unemployment insurance (UI) tax increases, and spread them out over five years, rather than the normal four years. It did so by suspending the solvency surcharge that is normally triggered when the UI Trust Fund balance is reduced to less than seven months of benefits, and implementing a temporary, five-year, stepped increase in the social tax component at rates lower than had been required by statute. However, the bill did not sufficiently address the experience-rated tax component, which is based on how frequently employers lay off or terminate workers, and the amount of benefits paid to those displaced workers. Nor did this bill backfill or otherwise offset the massive theft of UI funds through fraudulent claims allegedly perpetrated by Nigerian crime rings. NFIB initially opposed the bill due to these shortcomings, and the increase in benefit costs it also contained. We explain the UI tax situation here, and our letter to Senate committee leadership outlining our objections is available here. We are pleased the Legislature did, in fact, act before the session ended to provide additional, targeted relief of experience-rated charges by utilizing federal COVID-relief funds.

- SB 5478, unemployment insurance relief – The Senate concurred with House amendments to this bill, which will provide $500 million in targeted unemployment insurance tax relief to employers hit hardest by shutdowns and slowdowns ordered in response to the COVID-19 pandemic. More than one-third of the aid is restricted to small businesses with 20 or fewer employees, most in one of 17 specific North American Industrial Classification System (NAICS) sectors. Some 30% of the funds may be available to larger firms, those with 21 to 4,999 employees, whose experience rating jumps at least four rate classes from 2021 to 2022. (That is a substantially lower employee count than the 40,000-worker cap contained in the original Senate bill.) Basically, these funds will be used in 2022 to “buy down” the experience-rated charges that would otherwise apply to qualifying businesses’ UI accounts, providing immediate and longer-term UI tax relief as a result. NFIB supported the bill.

Previous Reports and Related News

- January 23—Week 2: Legislative Report. House passes NFIB-backed B&O tax exemption for PPP, EIDL loans

- January 15–Week 1: Legislative Report. Senate Bill Would Stop the State from Following the “Roadmap to Ruin”

- January 10–Spokesman-Review Guest Editorial: Inslee Agenda Seeks to Destroy Even More Small Businesses