Conversation in Colorado is slowly shifting to liability protection

FOR IMMEDIATE RELEASE

Contact: Tony Gagliardi, Colorado State Director, [email protected],

or Tony Malandra, Senior Media Manager, [email protected]

DENVER, June 2, 2020—Poll results released today by the nation’s leading small-business association found time slipping away to ask for loan forgiveness from the Paycheck Protection Program, but NFIB’s Colorado state director says another issue is also causing a great deal of anxiety—one the state will need to address given federal dawdling on the matter: Liability protection.

“Small-business owners are nervous about being whacked with lawsuits from customers and employees who could claim, without knowing for sure, that they contracted the COVID-19 virus at their places of business,” said Tony Gagliardi, Colorado state director for NFIB, which conducted the poll. “They desperately need and want some liability protection, and the conversation is only beginning in the Colorado General Assembly. Lack of protection is needlessly adding to the worry small-business owners are also having as their loan-forgiveness loan windows rapidly begin to close.”

NFIB’s liability protection principles can be read here.

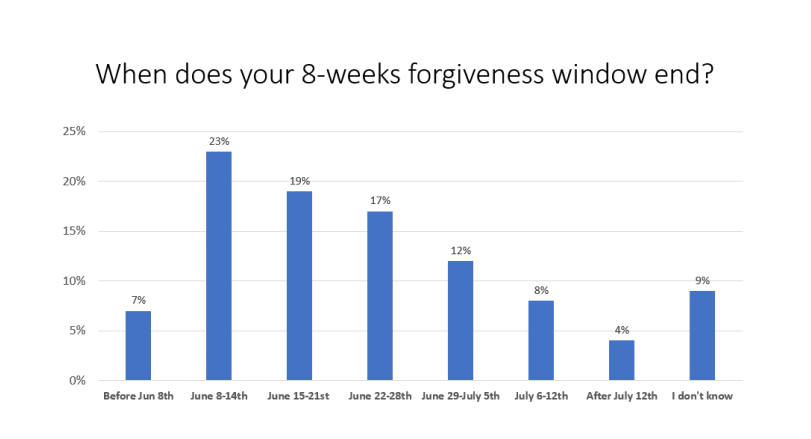

According to NFIB’s report of the poll results, “The PPP loan forgiveness conditions require small business owners to spend funds in an 8-week period starting the day they receive the loan. Qualifying expenses [payroll, rent, mortgage interest, or utilities] paid within the 8-week may be eligible for forgiveness.” Most small business borrowers are currently in the middle of their 8-week forgiveness window with some nearing the end of it. For 7% of those surveyed, that eight-week period ends before June 8, for 23% June 8-14, and then starts to decrease in percentages over time. Sixty-seven percent of small-business owners have found the loan very helpful, 14 percent moderately helpful, and 11 percent somewhat helpful.

Other findings from the poll include how much of the loan has been spent; applications for, and use of, Economic Injury Disaster Loans (EIDL); knowledge of the Federal Reserve’s Main Street Lending Program; and if any employees have taken COVID-19-related sick leave.

From Holly Wade, NFIB Director of Research & Policy Analysis

“The majority of small businesses are still negatively impacted by the economic crisis. Adding flexibility to the PPP loan forgiveness is one thing our elected officials can do to ease the burden on small businesses nationwide.”

Keep up with the latest Colorado small-business news at www.nfib.com/colorado or by following NFIB on Twitter @NFIB_CO or on Facebook @NFIB.CO

###

NFIB is the voice of small business, advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since our founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit www.nfib.com/Colorado.

NFIB Colorado

1700 Lincoln Street, 17th Floor

Denver, CO 80203

303-860-1778

www.nfib.com/colorado

Twitter: @NFIB_CO

Facebook: NFIB.CO