Legislative action needed to help reverse a troubling trend

FOR IMMEDIATE RELEASE

Contact: Chad Heinrich, Arizona State Director, [email protected]

or Tony Malandra, Senior Media Manager, [email protected]

PHOENIX, May 12, 2021—The latest annual Rich States, Poor States report released today had some sobering news for Arizona, which came in 13th place in the report’s economic outlook ranking.

“While we slipped three places in the ranking, are no longer in the top ten, and are approaching what could be a crisis of competitiveness, hope still remains that we can correct course,” said Chad Heinrich, Arizona state director for the National Federation of Independent Business (NFIB), which released its latest Small Business Economic Trends report, yesterday. Rich States, Poor States is produced by the American Legislative Exchange Council (ALEC).

Of the 15 variables the report uses for its economic outlook ranking, Arizona received poor grades for its top marginal personal income tax rate (42), state minimum wage rate (44), and sales tax burden (45).

“To help small businesses the State Legislature must focus on fixing the disparate tax treatment of commercial property, reforming Arizona’s individual income tax code with small businesses in mind, and making our unemployment insurance (UI) trust fund solvent without raising taxes on Main Street enterprises, the latter of which is not measured in the Rich States, Poor States report,” said Heinrich.

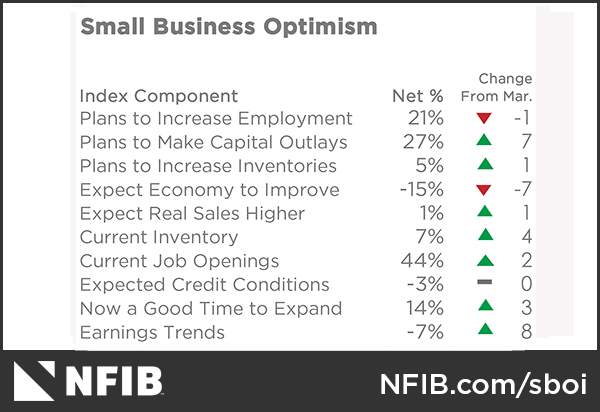

The NFIB poll released yesterday showed an increase in small business optimism over the previous month’s increase but keeping the small-business economy from soaring is the drag of record highs in unfilled job openings.

“Gov. Doug Ducey’s signing of liability protection legislation will help Arizona’s small businesses open with confidence as we return to pre-pandemic business operations, as will Arizona conforming with several small-business-focused tax provisions in the federal CARES Act. The two big questions Main Street entrepreneurs have are: Will they be hit with a double whammy if the legislature increases unemployment taxes while UI rates have also increased due to the pandemic and how deeply would a federal effort to raise the minimum-wage rate to $15 an hour affect their operations,” said Heinrich. Click here for the latest research on the minimum wage.

Keep up with the latest on Arizona small business news at www.nfib.com/arizona or by following NFIB on Twitter @NFIB_AZ

###

For 78 years, NFIB has been advocating on behalf of America’s small and independent business owners, both in Washington, D.C., and in all 50 state capitals. NFIB is a nonprofit, nonpartisan, and member-driven association. Since its founding in 1943, NFIB has been exclusively dedicated to small and independent businesses and remains so today. For more information, please visit nfib.com.

NFIB Arizona

24 W. Camelback Rd. #A252

Phoenix, AZ 85013

602-263-7690

NFIB.com/AZ

Twitter: @NFIB_AZ