The NFIB Research Center has released its findings on how taxes affect small businesses

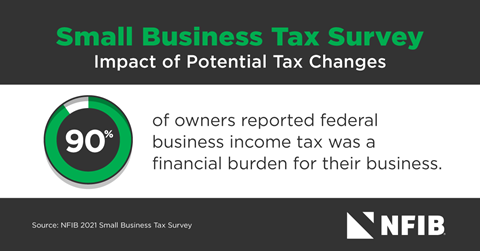

On August 9th, the NFIB Research Center released the results of survey on the biggest tax challenges for small businesses. The survey found that the vast majority of owners are burdened by taxes, which in addition to their high financial costs, provide significant administrative burdens.

“Taxes have been a long-standing concern and significant burden for small business owners,” said Holly Wade, Executive Director of NFIB’s Research Center. “The majority of owners report all the various forms of business taxes impose both a significant financial and administrative burden to their businesses. It is crucial that Congress and the administration protect policies that ease those burdens on small businesses, such as making the Small Business Deduction (section 199A) permanent.”

In the report, the most financially burdensome tax for small businesses was federal income tax, followed by payroll tax, then state and local taxes. Federal income taxes also proved the largest administrative challenge to most owners.

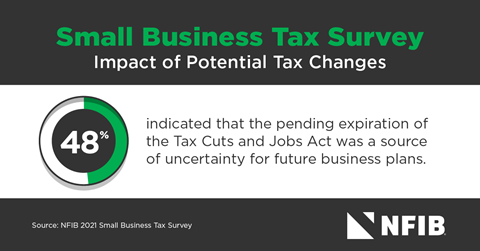

The Tax Cuts and Jobs Act of 2017 (TCJA) provided significant tax relief for small business owners, including the 20% Small Business Deduction (Line 13 on IRS Form 1040), lowering the federal income tax rates, and reducing the corporate income tax rate for most small C-Corp businesses. This tax relief continues to enjoy high favorability (78%) among owners, yet many TCJA relief provisions are set to sunset after 2025 and Congress is also currently considering other small business tax increases. Forty-eight percent of respondents expressed uncertainty of how the TCJA expiration will impact their business plans.

More than half of all owners (52%) plan to sell their businesses when it’s time to move on, with another 33% planning to pass the business to a family member. The latter would be made much more difficult by a proposed capital gains tax change that is currently being considered by Congress. Most respondents who intended to pass the business to a family member say their family member would have to either take a loan (38%) or sell part of the business (26%) to pay for a large capital gains tax.

NFIB wants to hear how high taxes have affected your small business. Make your voice heard by filling out a survey here.